Time: 2023-11-30

Time: 2023-11-30  Views: 255

Views: 255

[Foreword]

In order to better help customers implement digital projects, the "Decision Expert Column" is completely free and open source, paying tribute to Musk's open source spirit! Through 17+ years of professional digital service capabilities, a senior expert consulting team, and rich industry solutions, we continue to add value to the digital transformation of enterprises!

This article is based on Mr. Yang Yongqing, Decision’s chief financial expert, who has 24 years of rich experience in the field of SAP ERP, and combines the common misunderstandings he found in the implementation of ERP projects to publish corresponding research insights and suggestions to protect your SAP financial implementation and delivery.

[Problem Description]

After accounting for the prepayment of equipment assets, it was found that the system treated the prepayment amount of the asset as the original value to calculate depreciation.

As shown in the figure below, voucher 1 is a prepayment voucher, and the corresponding asset number is entered in the prepayment line item. When the voucher is saved, the system automatically generates two vouchers, one is an ordinary prepayment voucher, and the other is the prepayment amount voucher of the asset. And an allowance account 1601999998 is used. When AS03 checked the asset master data, it was found that the prepaid amount of 1 million was regarded as the original value, and depreciation was calculated from the next month. What is the reason? How to deal with it?

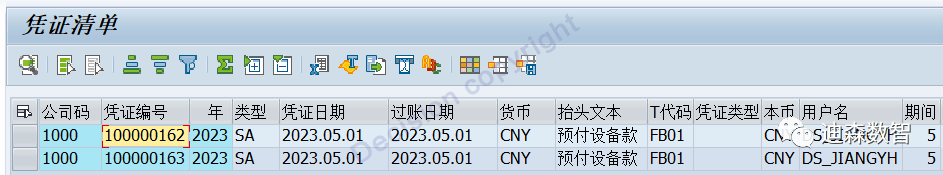

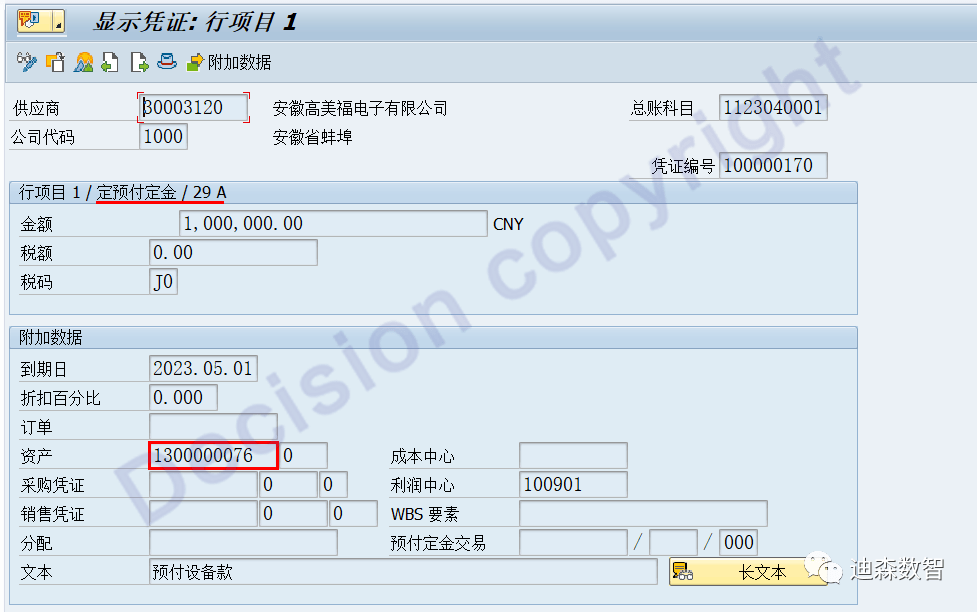

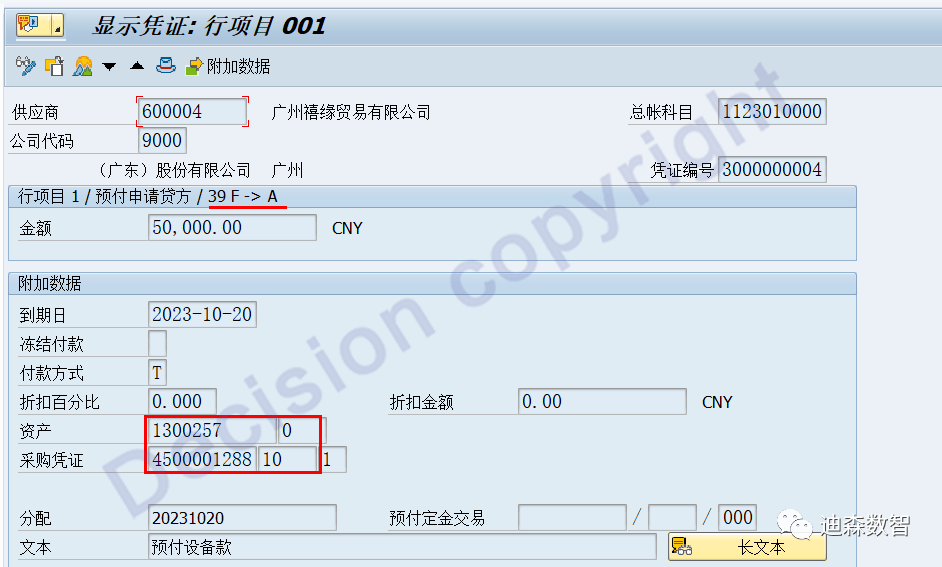

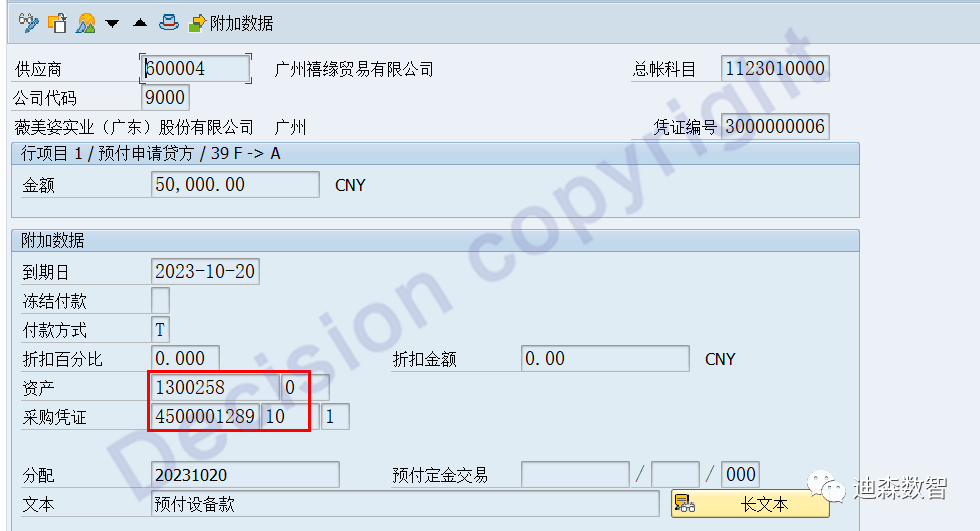

Voucher 1: Prepayment Voucher

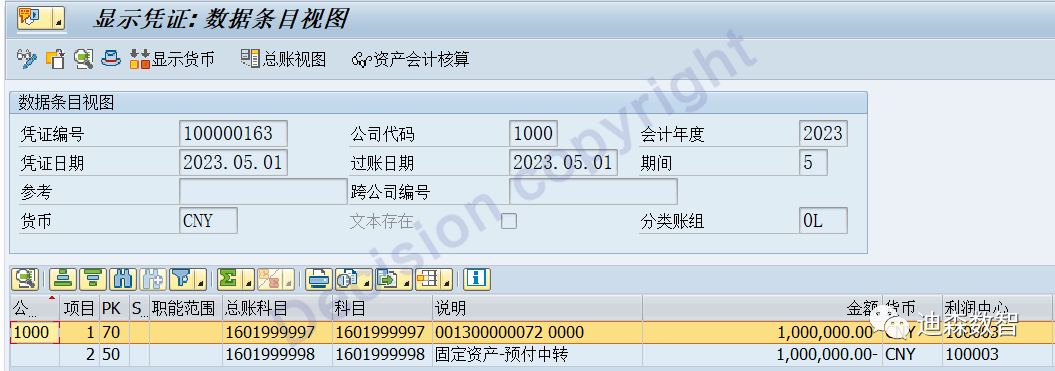

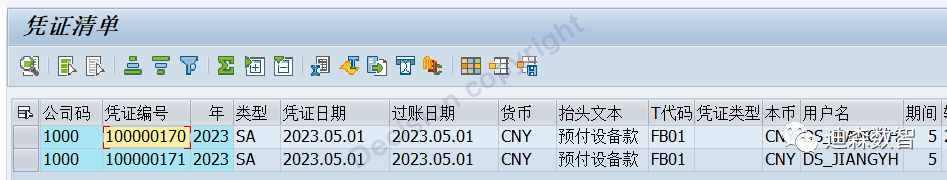

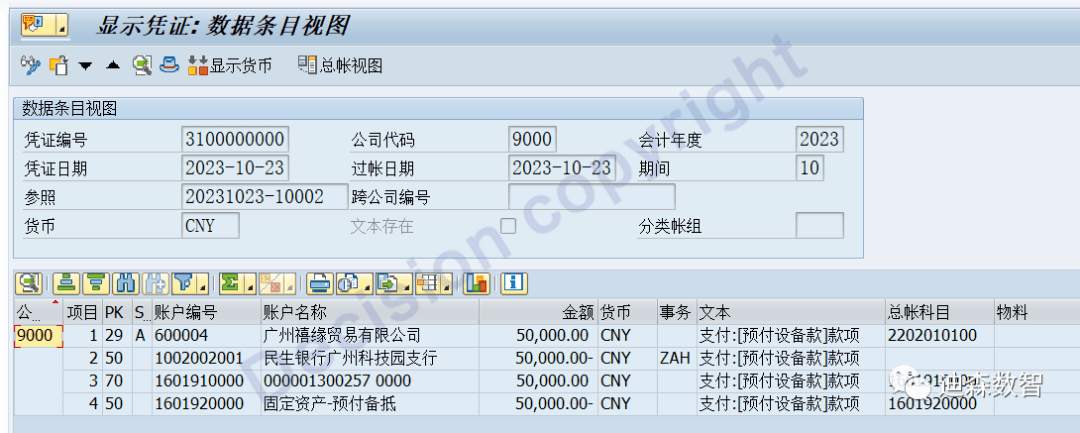

Voucher 2: Enter once and generate two vouchers at the same time. The second one is the asset prepayment record.

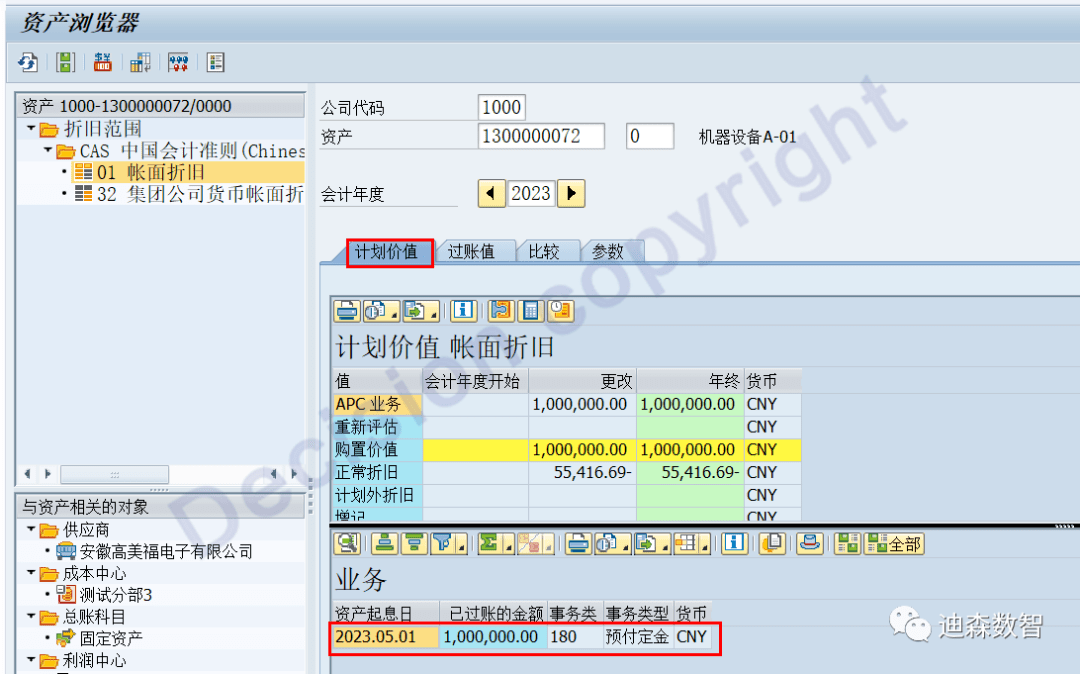

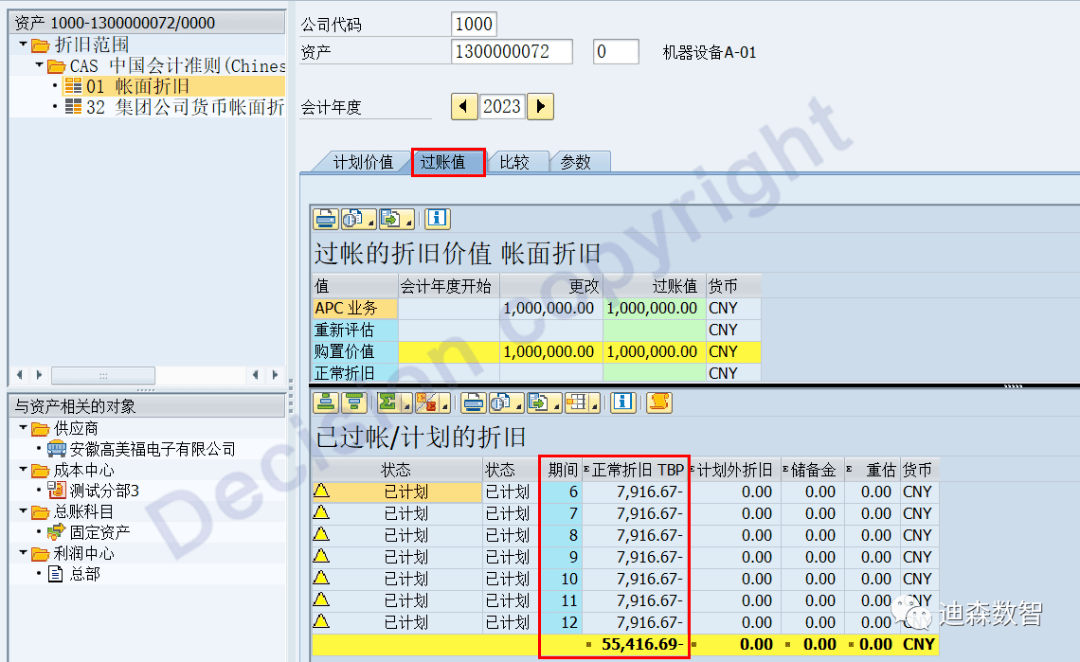

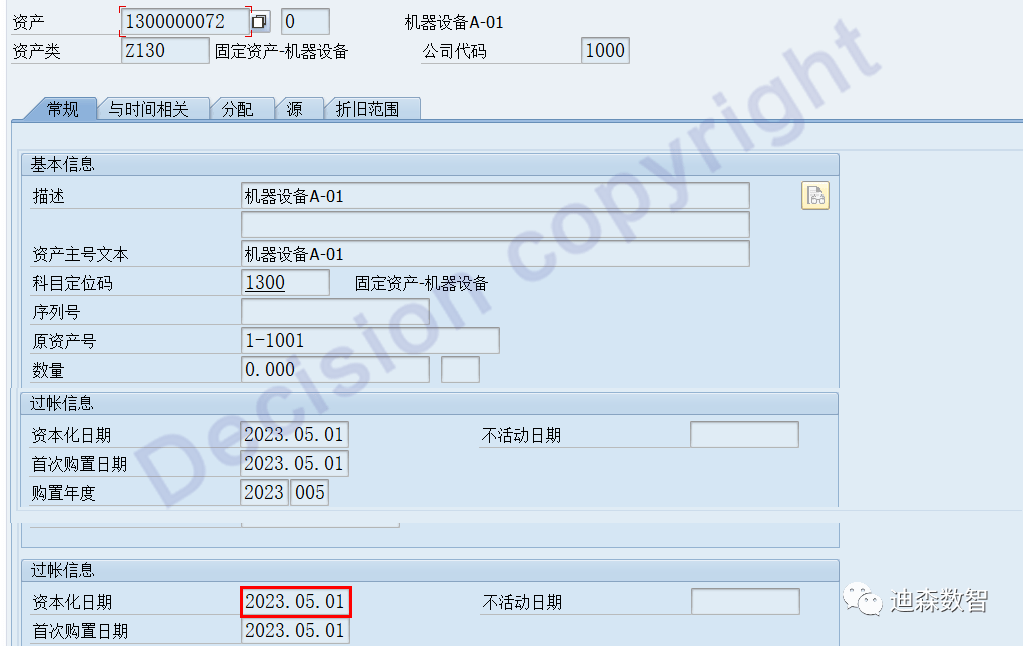

In asset master data:

Capitalization date, the system fills in the advance payment posting date to the capitalization date

The system automatically fills in the depreciation start date based on the capitalization date.

[Problem analysis]

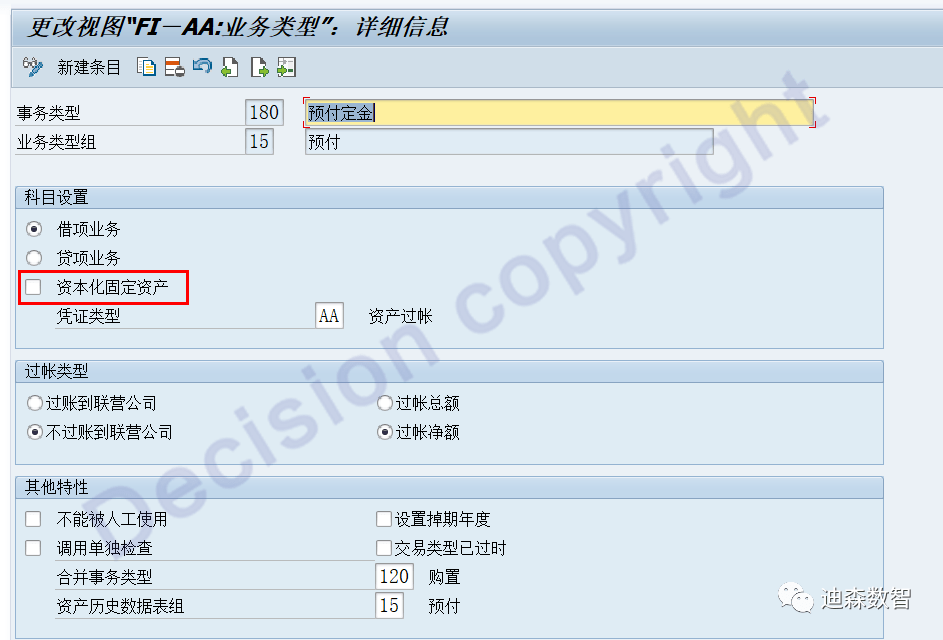

① For asset transactions 180 and 181, the system can specify whether to use it as a capitalized amount.

② Because the advance payment for some state assets, as a capitalized amount, is deemed to have increased in original value.

[Solution]

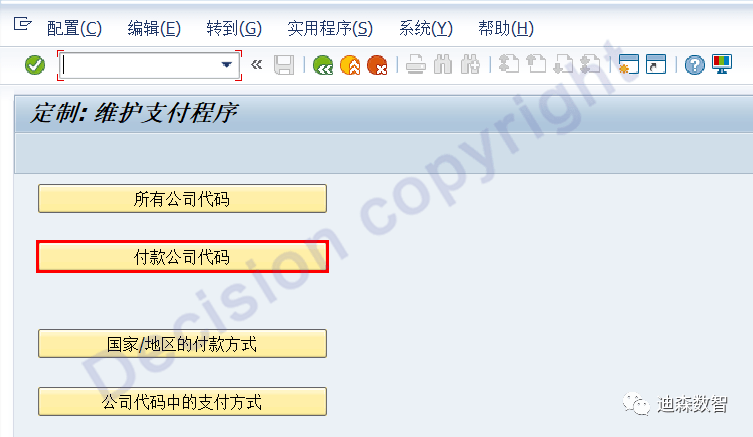

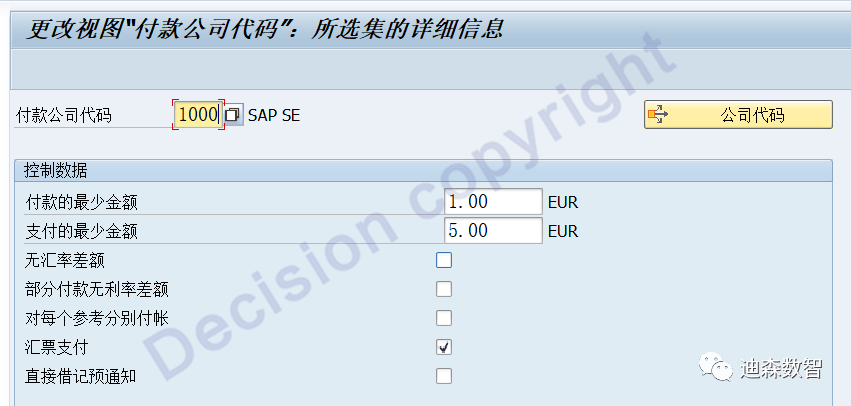

① Transaction code FBZP maintains automatic payment company

Copy 0001 data to 1000 company code

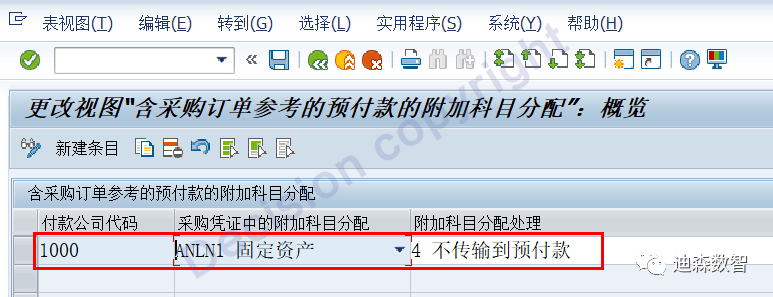

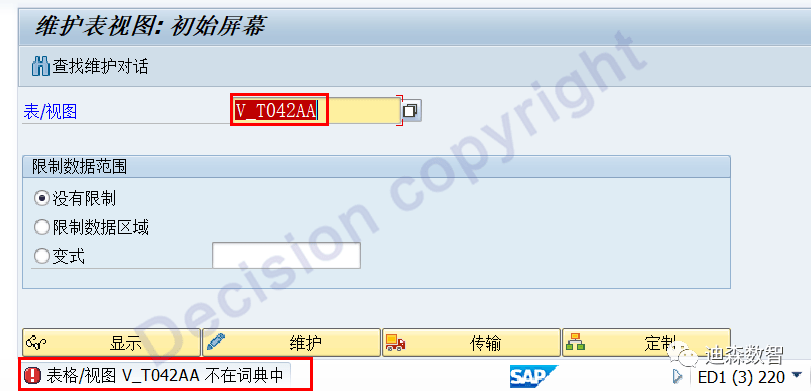

② Transaction code SM30 view: V_T042AA

Create a record for company code 1000 (without transferring the down payment to the asset) as follows:

③ Test verification

3.1 Create a new asset 1300000073

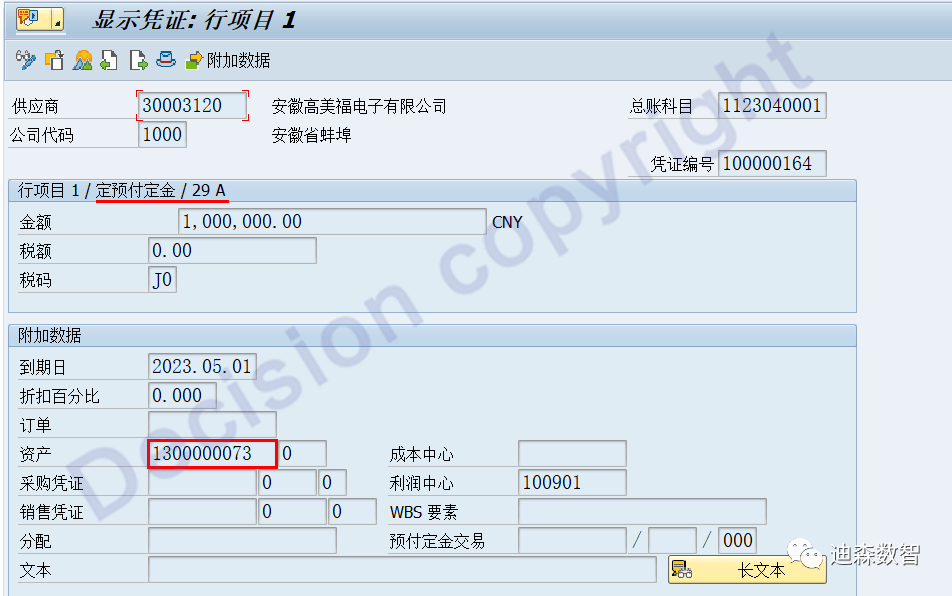

3.2 Advance payment posting is as follows:

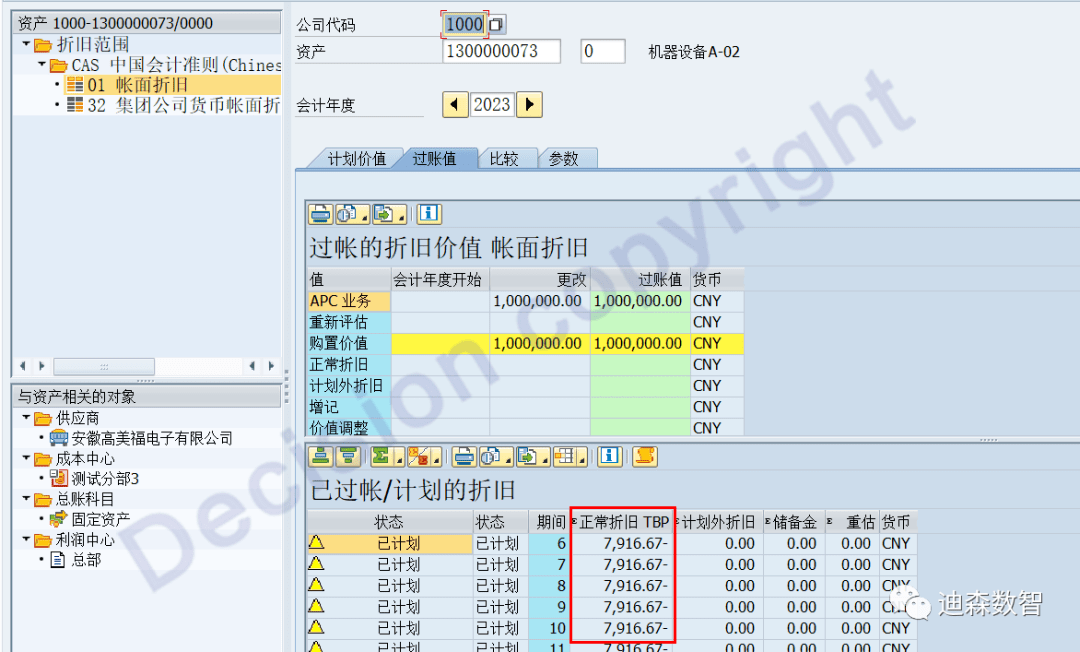

3.3 Check the asset card information and find that the prepayment amount is still included in the calculation of depreciation.

3.4 Test failed

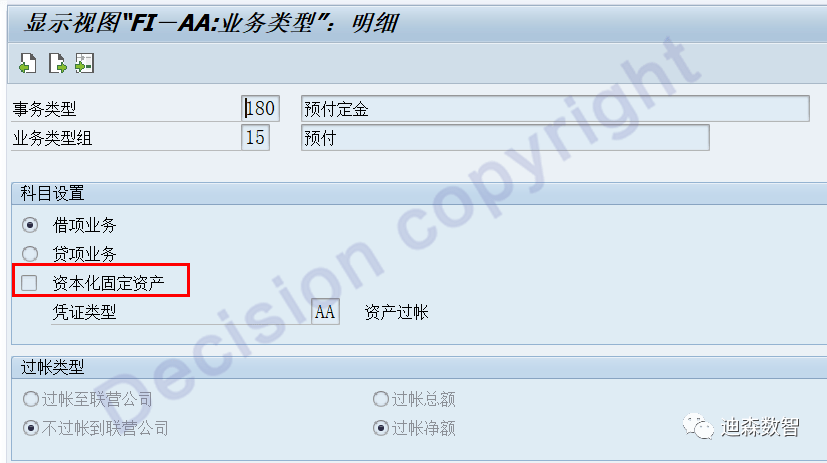

④ Transaction code AO73 For transactions 180 and 181, uncheck "Capitalized fixed assets"

⑤ Test again

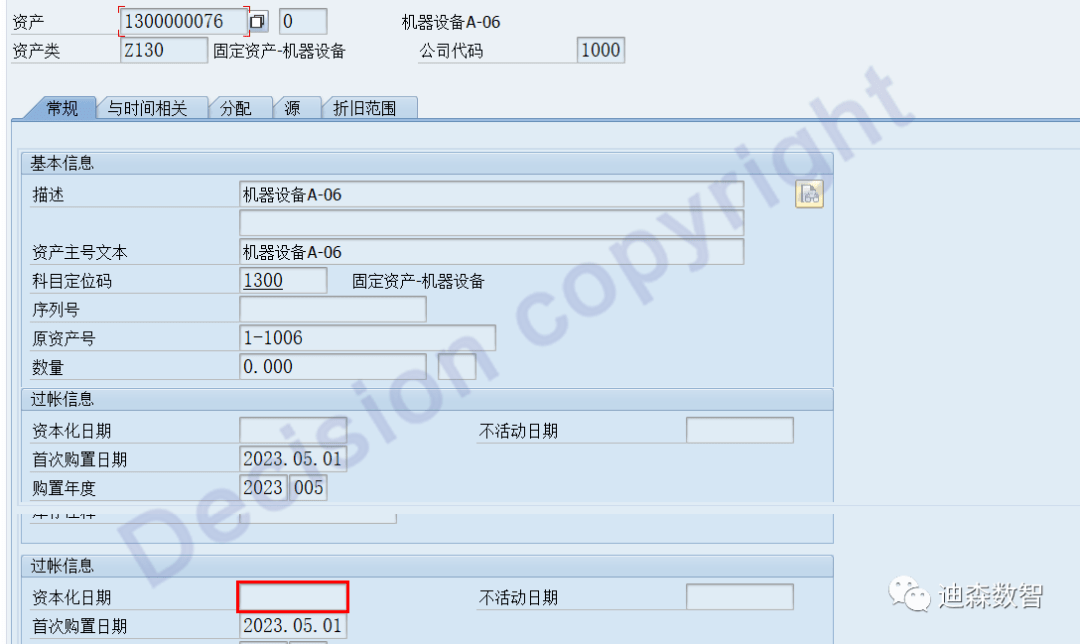

5.1 Create a new asset 1300000076

5.2 Advance payment posting is as follows:

5.3 The system still generates two vouchers: one is the ordinary prepayment voucher, and the other is the asset’s prepayment amount voucher.

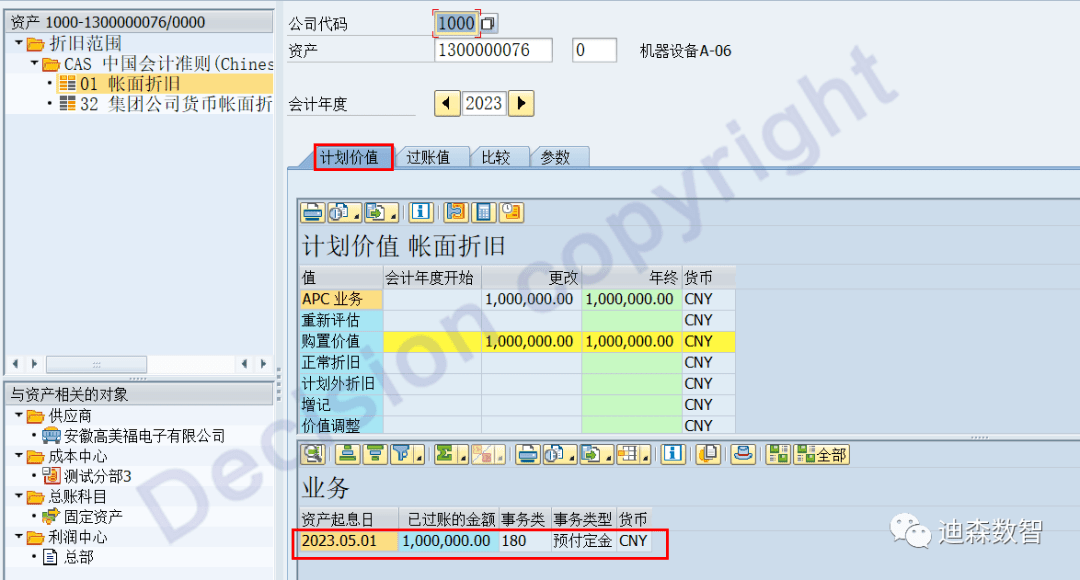

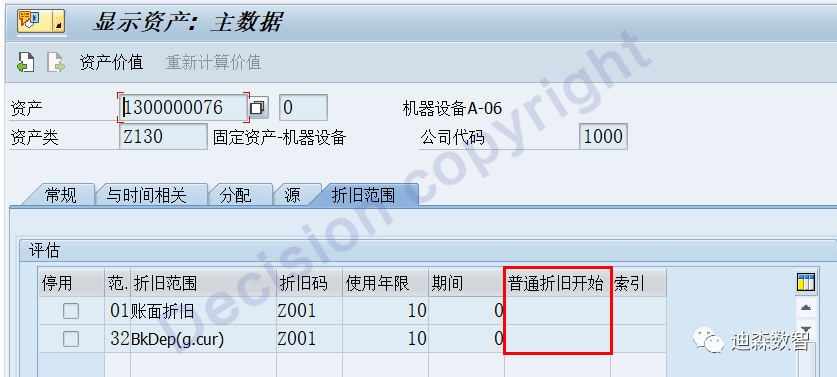

5.4 Check the asset card information and find that the prepayment amount is no longer included in the calculation of depreciation.

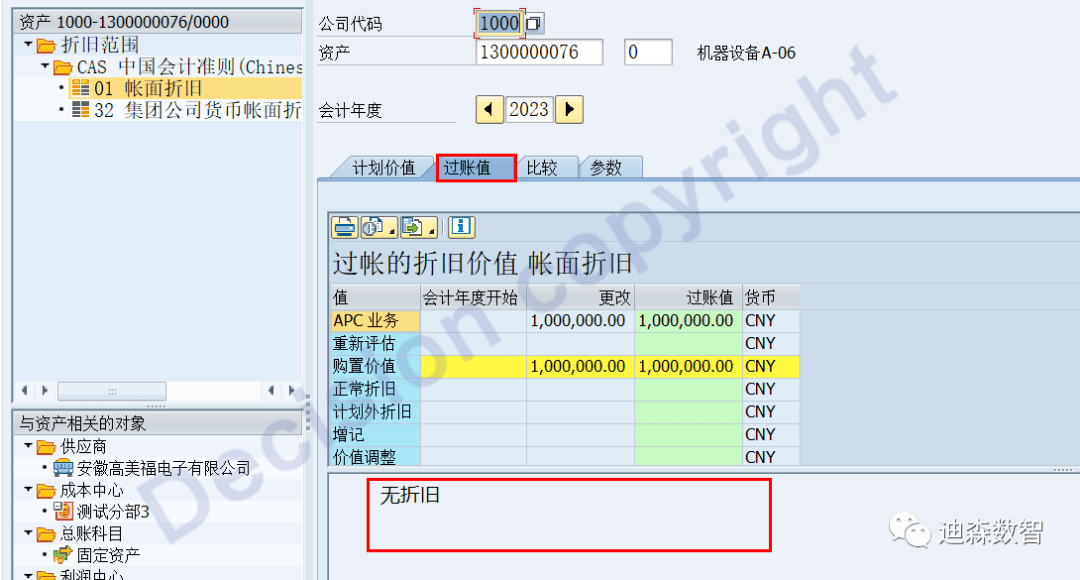

Check the master data capitalization date, it is empty, the prepayment date is no longer retrieved, and the depreciation start date is also empty.

Test success!

[Summarize]

(1) You only need to modify the configuration of AO73 for transactions 180 and 181, and uncheck "Capitalized fixed assets";

(2) After modification, it will only be effective for subsequent business; it will not be effective for asset advances that have already occurred.

[Attachment: ECC6.0 EHP7 test]

Test scenario one: Asset transaction 180, using default configuration

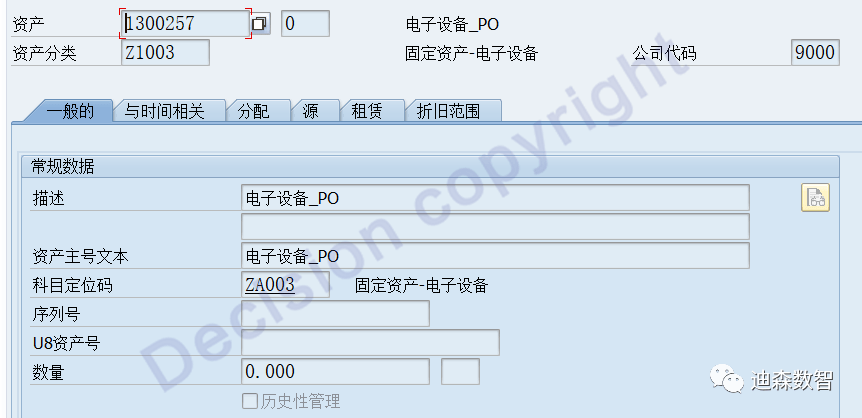

① Create fixed asset master data 1300257

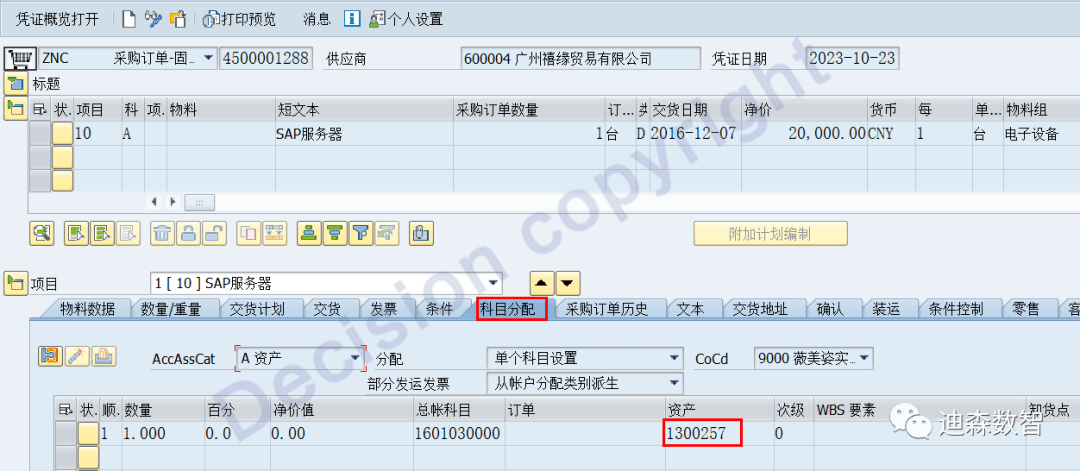

② Transaction code ME21N creates purchase order

③ Transaction code F-47 creates advance payment application

④ Check the asset master data value and you can see the advance payment application, which is not displayed in the asset master data.

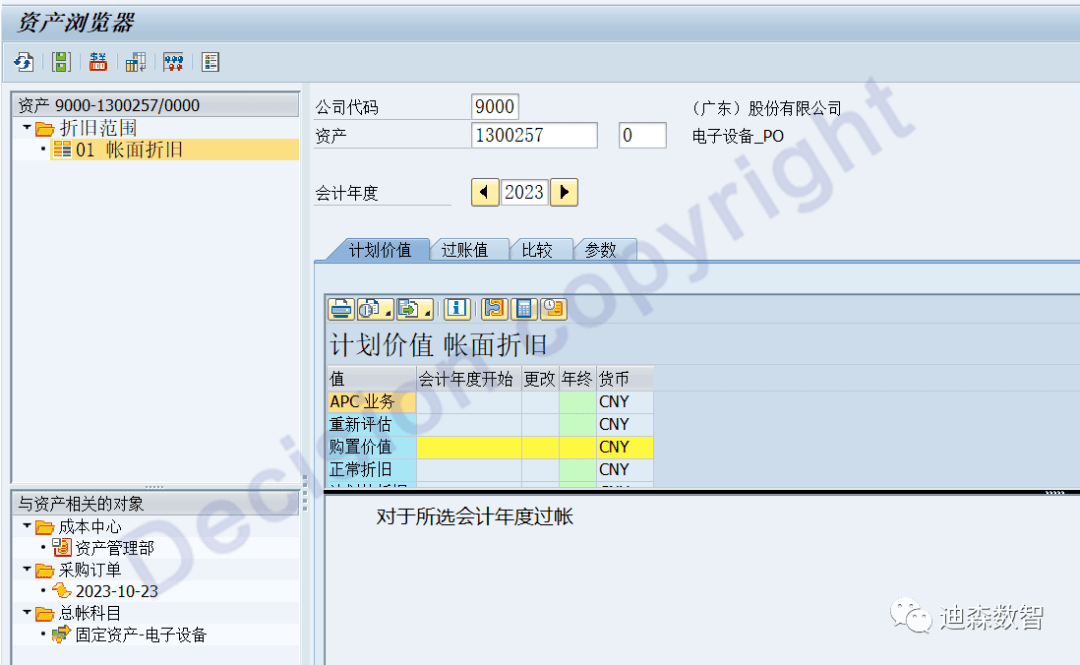

⑤ Transaction code F110 automatic payment, successful posting

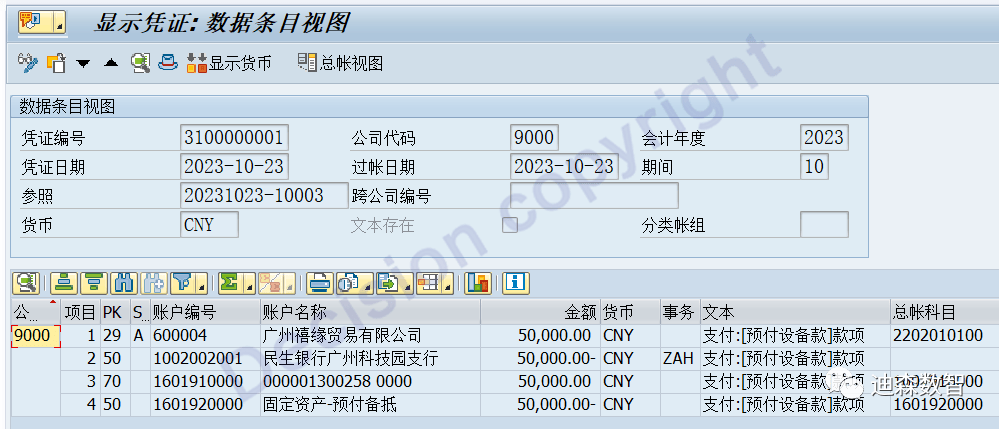

⑥ Transaction code FB03, view payment voucher

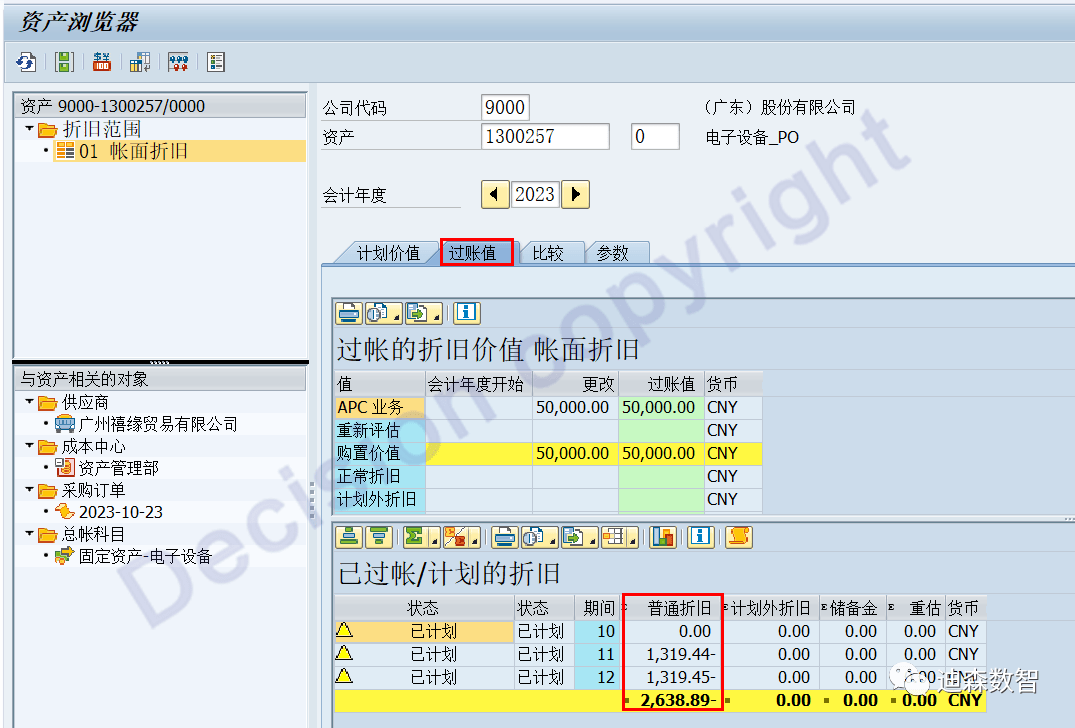

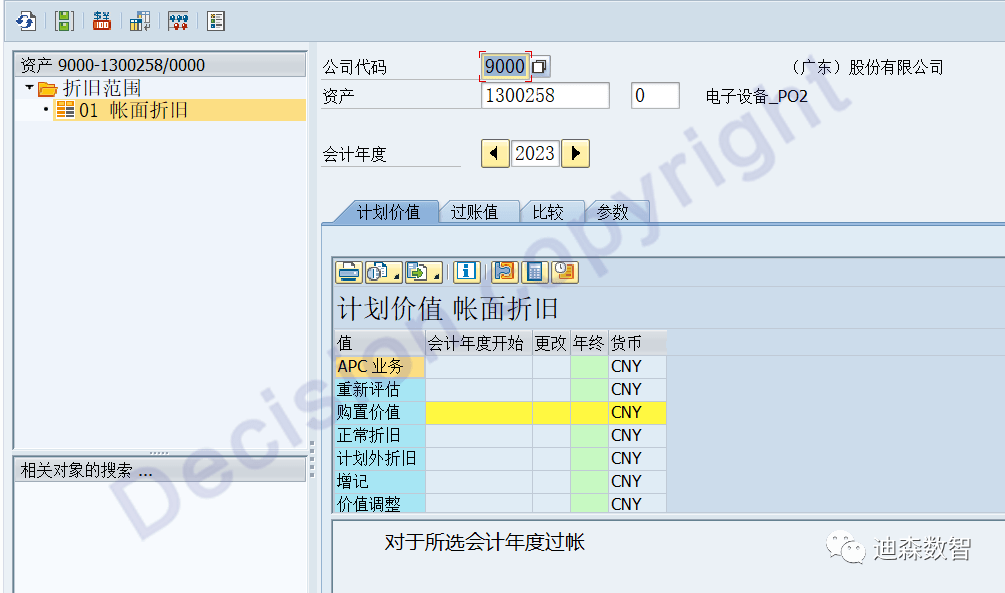

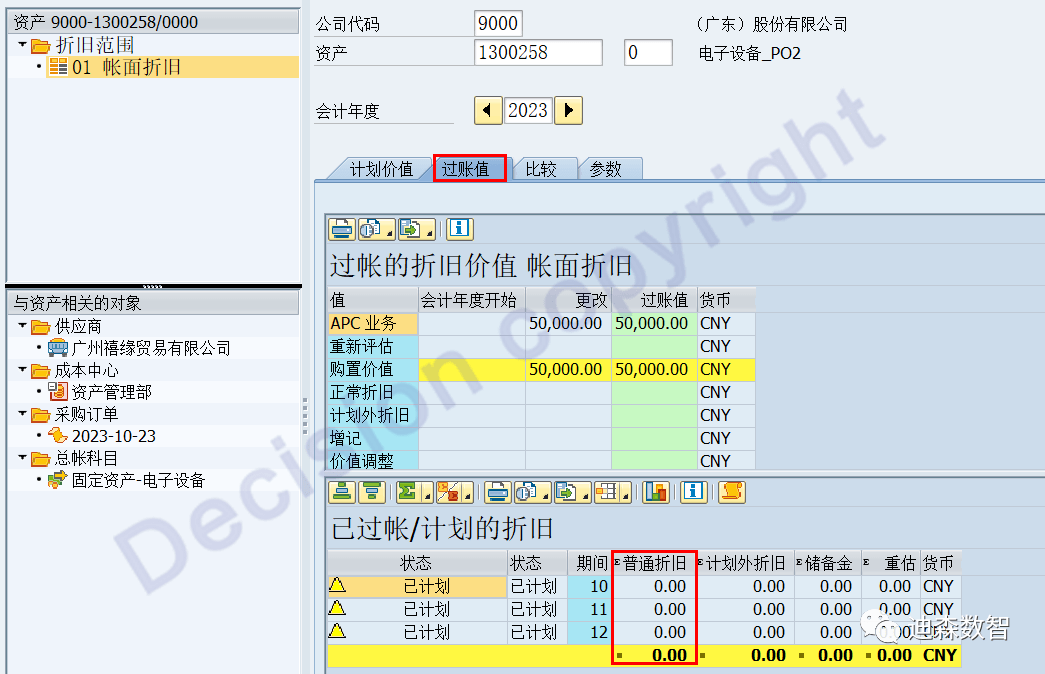

⑦ Transaction code AS03 View asset master data value

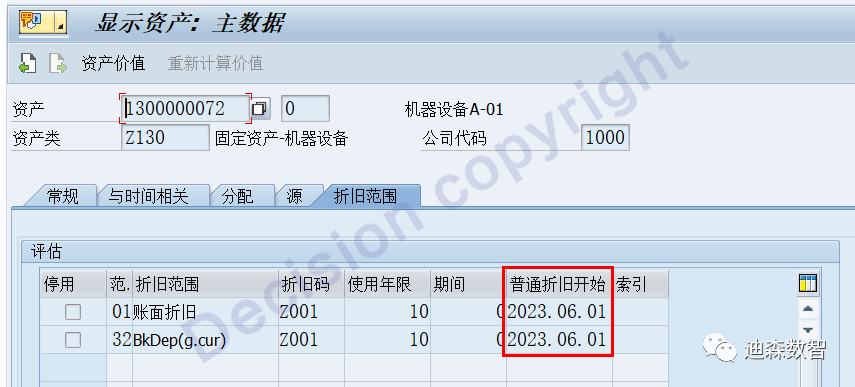

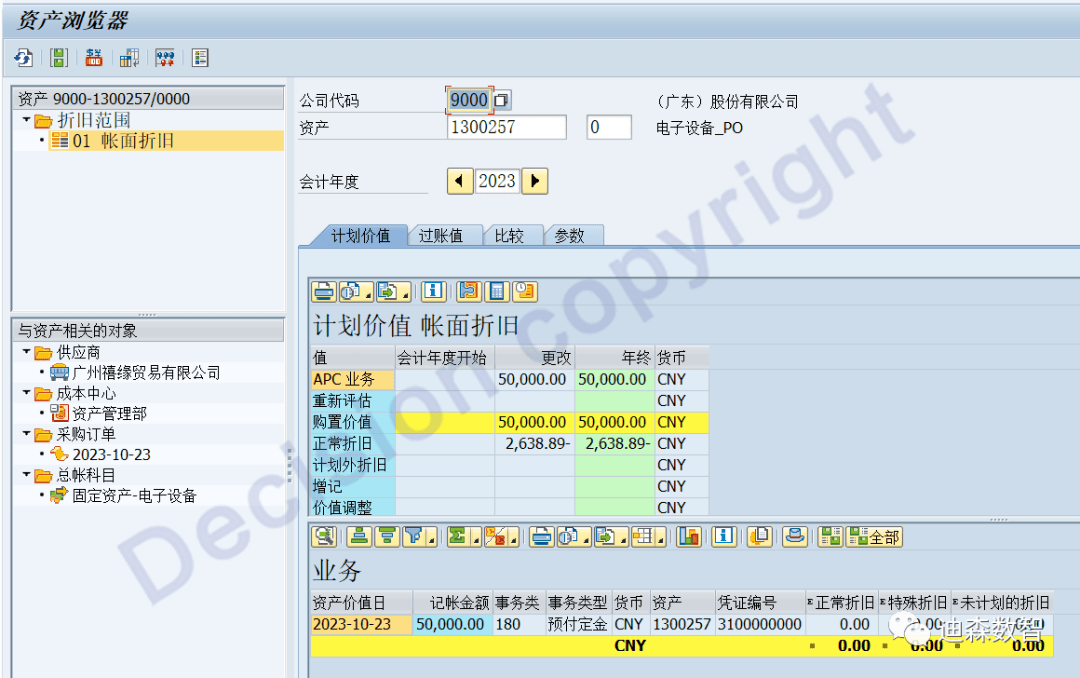

As above, you can see that the prepayment amount is used in depreciation calculations.

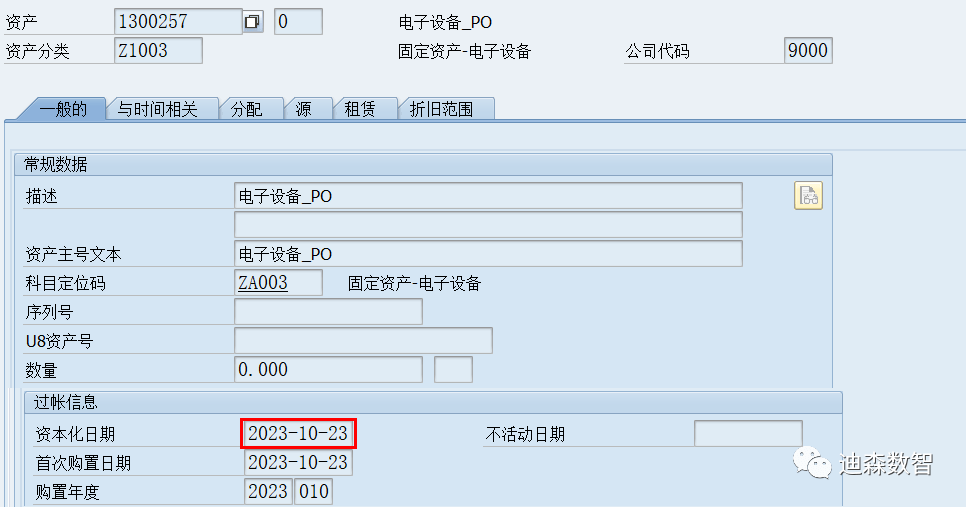

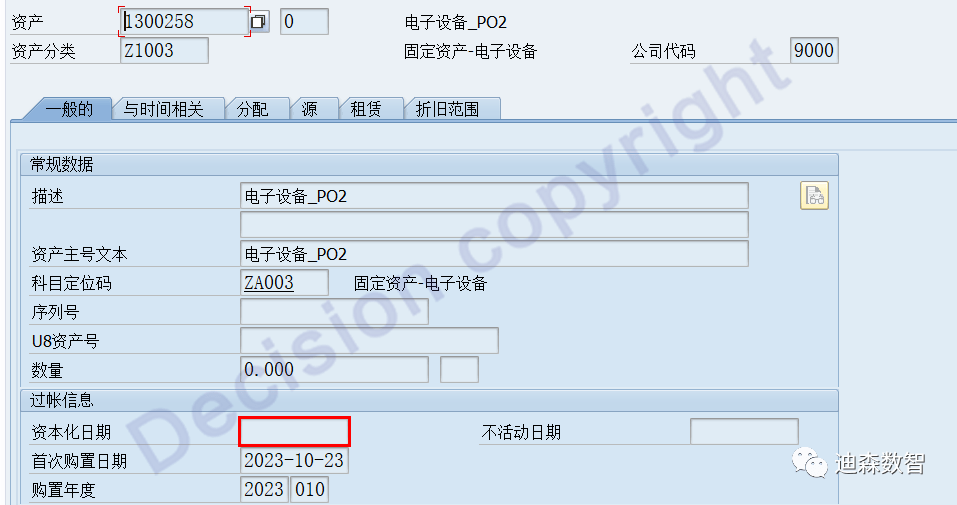

As above, you can see that the system treats the prepayment date as the capitalization date!

Test scenario two: Asset transaction 180, modify, remove: capitalized fixed assets (transaction code AO73)

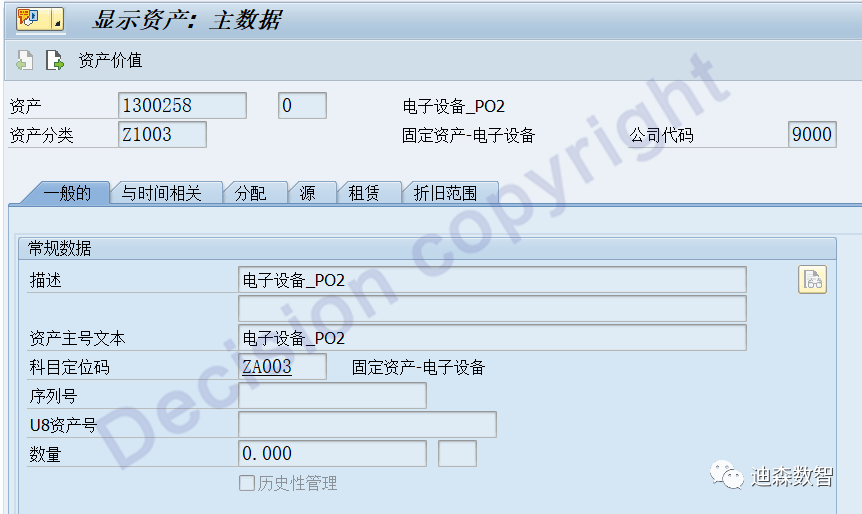

① Create asset master data

② Transaction code ME21N creates purchase order

③ Transaction code F-47 creates advance payment application

④ Check the asset master data value and you can see the advance payment application, which is not displayed in the asset master data.

⑤ Transaction code F110 automatic payment, successful posting

⑥ Transaction code FB03, view payment voucher

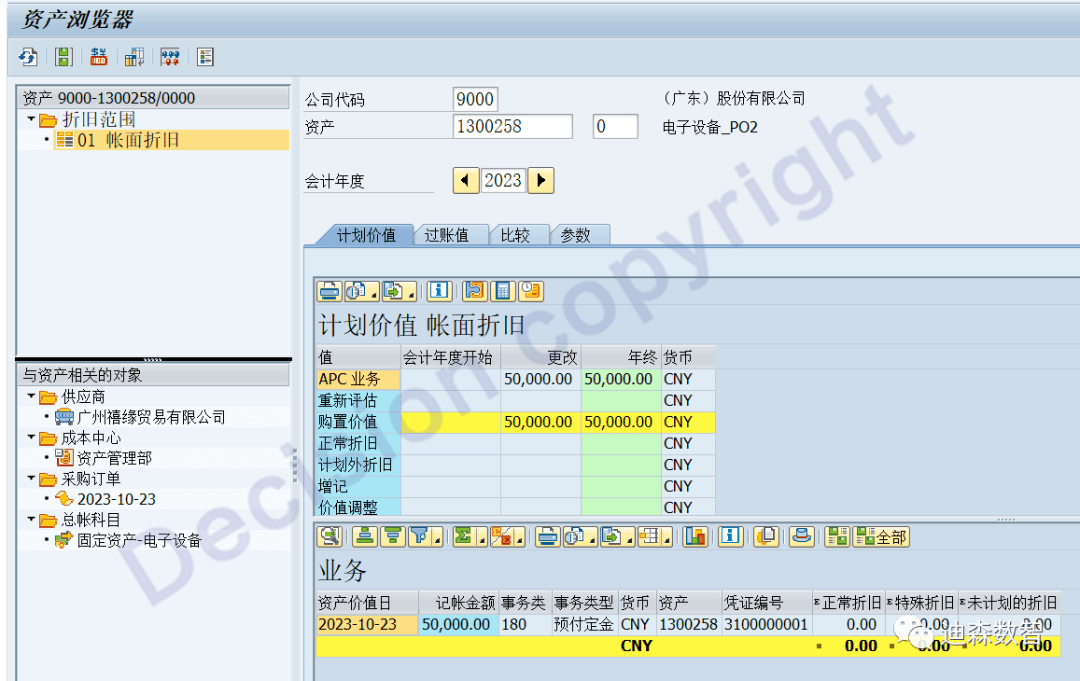

⑦ Transaction code AS03 View asset master data value

As shown in the figure above, the prepayment amount is not regarded as the original value and cannot be used to calculate depreciation. (The S4 system goes a step further and directly displays no depreciation).

As shown in the figure above, you can see that the prepayment date does not update the capitalization date.

Also: In ECC 6.0 systems, view V_T042AA , does not exist.

【Service Guide】

For more information on SAP courses, project consultation and operation and maintenance, please call Decision's official consultation hotline: 400-600-8756

【About Decision】

Global professional consulting, technology and training service provider, SAP gold partner, SAP software partner, SAP implementation partner, SAP official authorized training center. Seventeen years of quality, trustworthy!