Time: 2023-10-20

Time: 2023-10-20  Views: 345

Views: 345

[Foreword]

The reason why Decision is highly praised by enterprises during the implementation of digital transformation projects is because experts are escorting Decision during the project process to help enterprises gain new knowledge, grow new capabilities, and improve management during the implementation of digital transformation projects. To improve our vision and reduce project misunderstandings, we have specially set up a "Decision Expert Column" to share with you a series of articles on the implementation of digital transformation projects, so stay tuned.

This article is based on Mr. Yang Yongqing, Decision’s chief financial expert, who has 24 years of rich experience in the field of SAP ERP, and combines the common misunderstandings he found in the implementation of ERP projects to publish corresponding research insights and suggestions to protect your SAP financial implementation and delivery.

Do you still issue localized cash flow statements for your company through development?

Learn from Decision experts - how to use standard functions to implement a localized cash flow statement in China!

[Problem Description]

SAP has developed the IDCN China localized report function for Chinese users. IDCN China localized reports enable the issuance of balance sheets, income statements, and cash flow statements. However, in project implementation applications, most consultants still do not use this standard function and still implement report issuance through ABAP secondary development. As a consultant who has used IDCN reports in projects 11 years ago, this is very speechless. It is necessary to teach everyone how to issue IDCN reports step by step.

[IDCN report advantages]

(1) The balance sheet, income statement, and cash flow statement do not require secondary ABAP opening and configuration;

(2) Report output support: online output, EXCEL output, PDF output

(3) Online viewing supports double-click penetration query details;

(4) Support segment report inquiry (business scope/profit center);

(5) Support foreign currency conversion of legal person statements in different functional currencies;

(6) There is no need to wait for the monthly settlement, reports can be issued 24/7.

[Detailed demonstration]

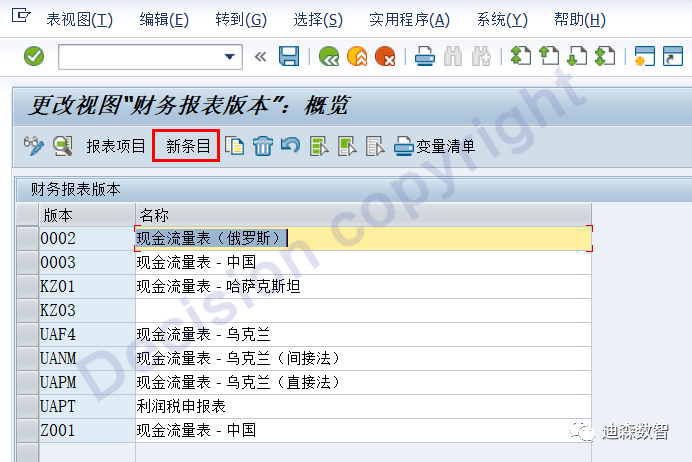

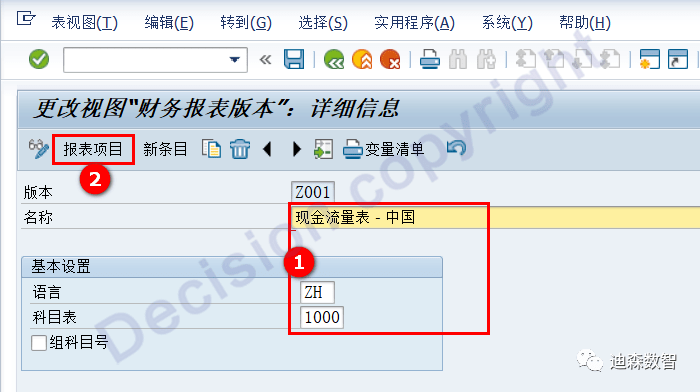

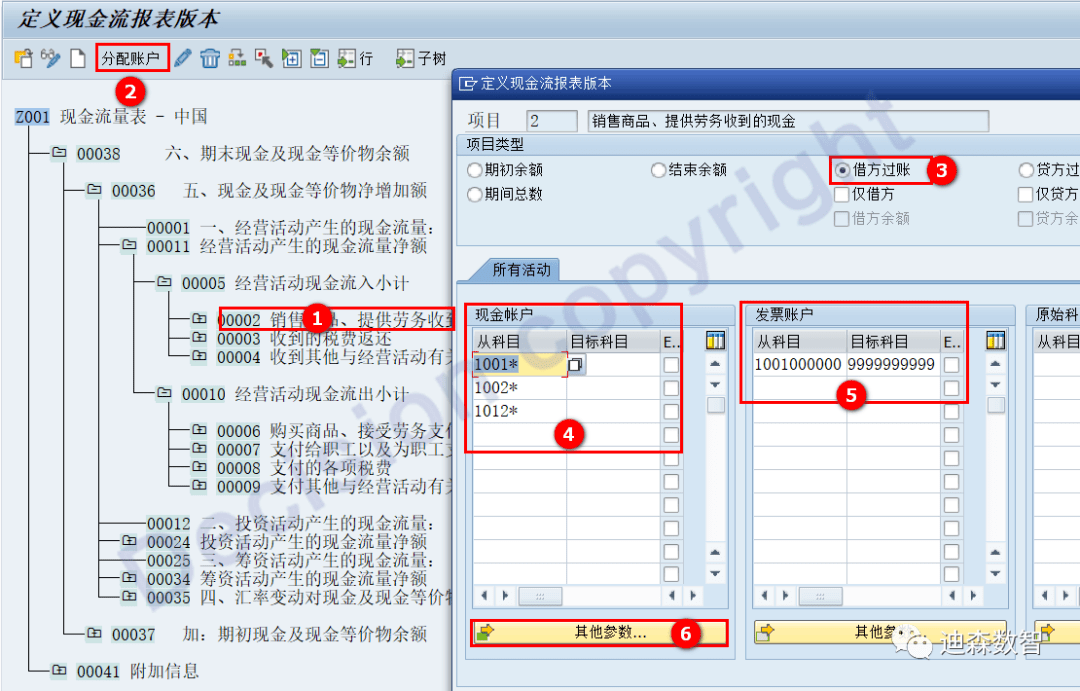

①Define cash flow statement version

IMG -> Financial Accounting -> General Ledger Accounting -> Periodic Processing -> Reports -> Statutory Reports: China -> Financial Statements -> Cash Flow Statements -> Define Cash Flow Statement Version

Click: "New Entry" to create a new cash flow statement, you can also copy reference 0003 provided by SAP.

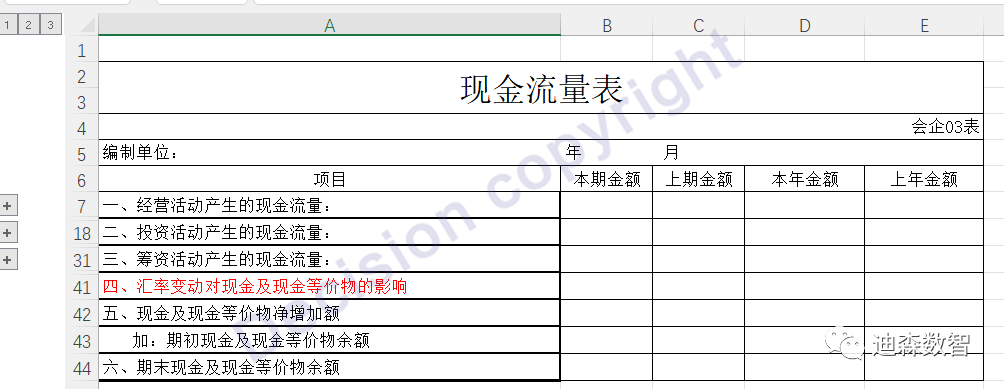

The figure below is the cash flow statement (direct method) format provided by the user.

As shown in the figure below, the cash flow statement of the direct method is defined. For content items with the same node level, they are output in the order of the nodes. After the system outputs the lower-level nodes, it displays "V. Net increase in cash and cash equivalents", that is: report output After 34 and 35, output 36 "V. Net increase in cash and cash equivalents".

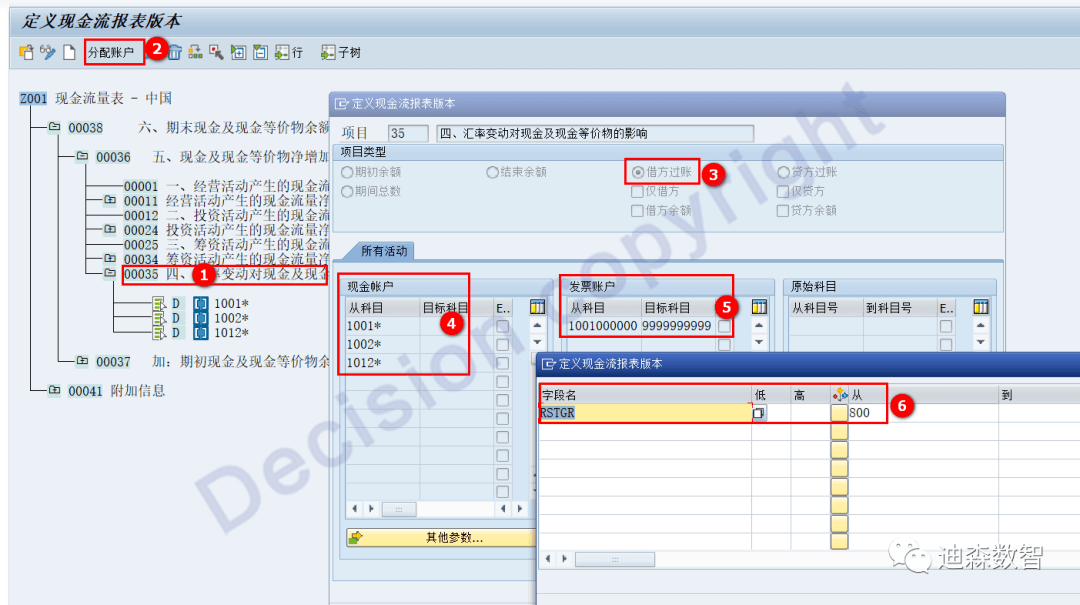

A. Get the cash inflow amount during the period according to the reason code:

illustrate:

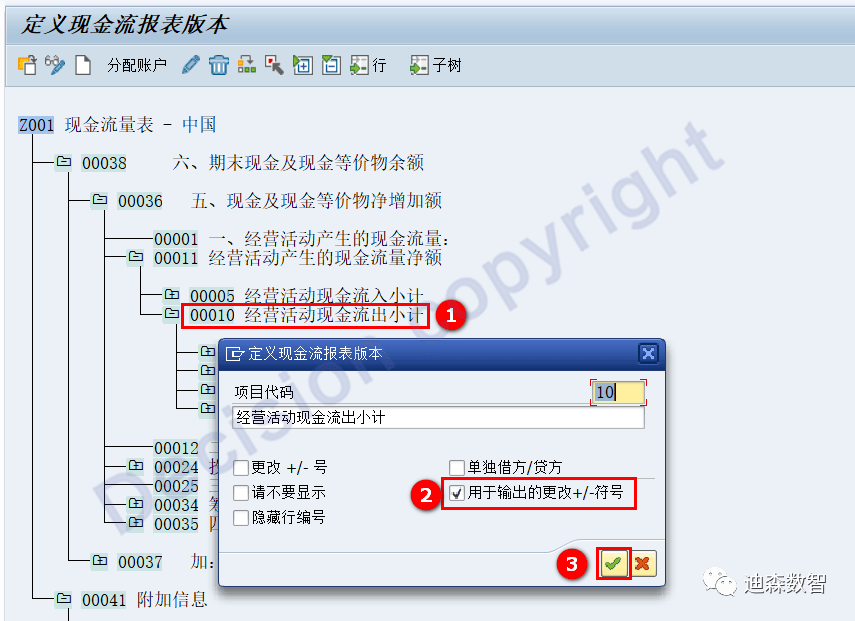

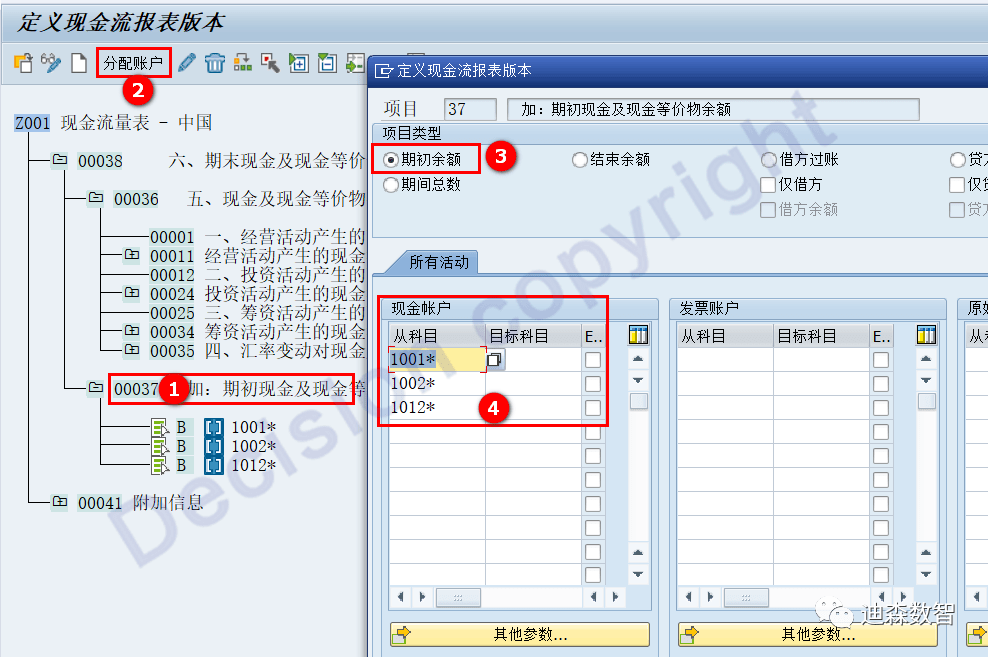

For cash account, enter 1001* 1002* 1012* including all cash, bank deposits, and other monetary funds.

Invoice account: Enter 1001000000 to 9999999999, that is, all counterparty accounts

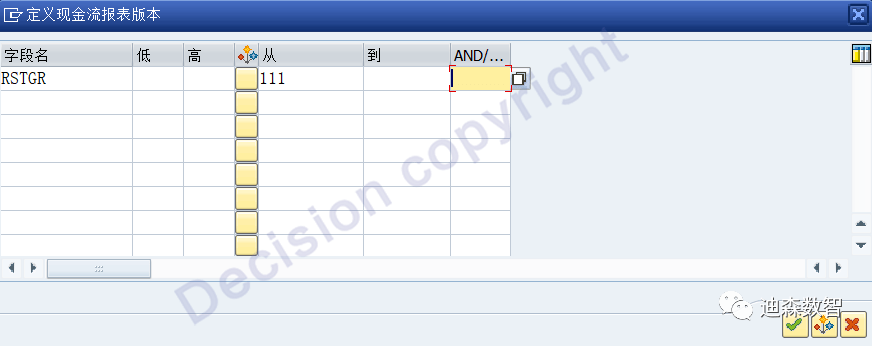

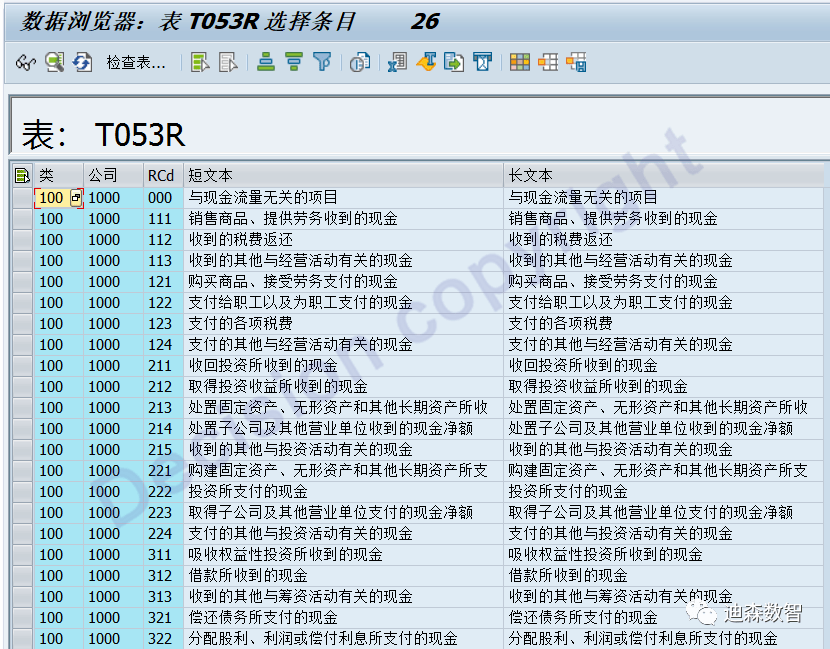

Click "Other Parameters" to maintain the specified reason code. The reason code is queried from the data table T053R table.

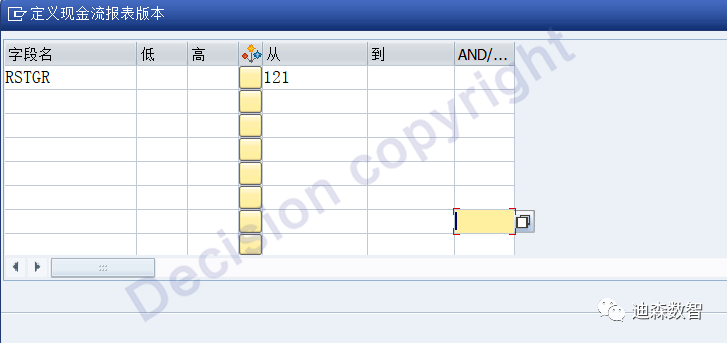

B. Get the cash outflow during the period according to the reason code:

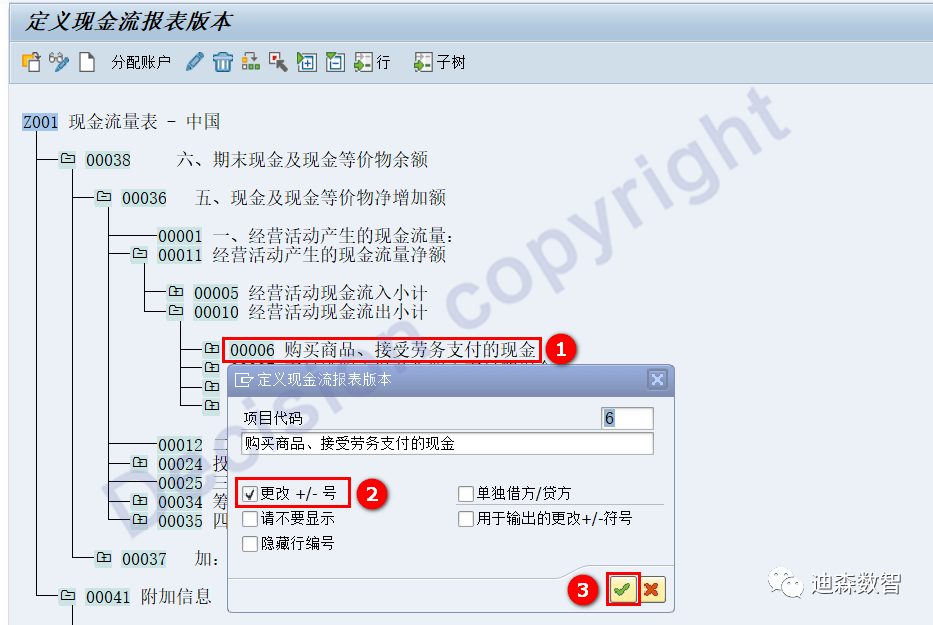

Cash flow outflow, plus or minus sign adjustment:

Cash flow outflow subtotal, plus or minus sign adjustment:

C. Take the opening cash balance:

D. Get the amount affected by exchange rate changes

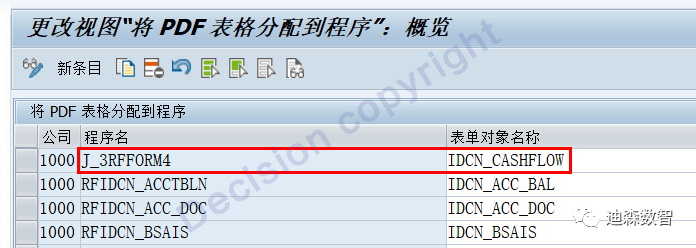

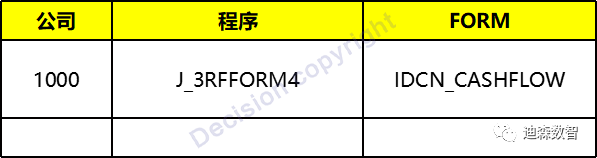

②Define the output PDF table

IMG -> Financial Accounting -> General Ledger Accounting -> Periodic Processing -> Reports -> Statutory Reports: China -> Financial Statements -> Assign PDF Form to Program

IDCNCASH - Cash flow statement (China) can be output in PDF format when used, and SAP also presets the corresponding FORM format. It needs to be set and allocated before use.

(1) Configuration

IMG -> Financial Accounting (New) -> General Ledger Accounting (New) -> Periodic Processing -> Reports -> Statutory Reports: China -> Financial Statements -> Assign PDF Forms to Programs

(2) View or modify FROM format (transaction code SFP)

Before using transaction code: Adobe liveCyde Designer 8.0 (applicable to GUI720/730) needs to be installed.

(3) Before outputting in PDF format, BASIS needs to be processed according to NOTES 685571.

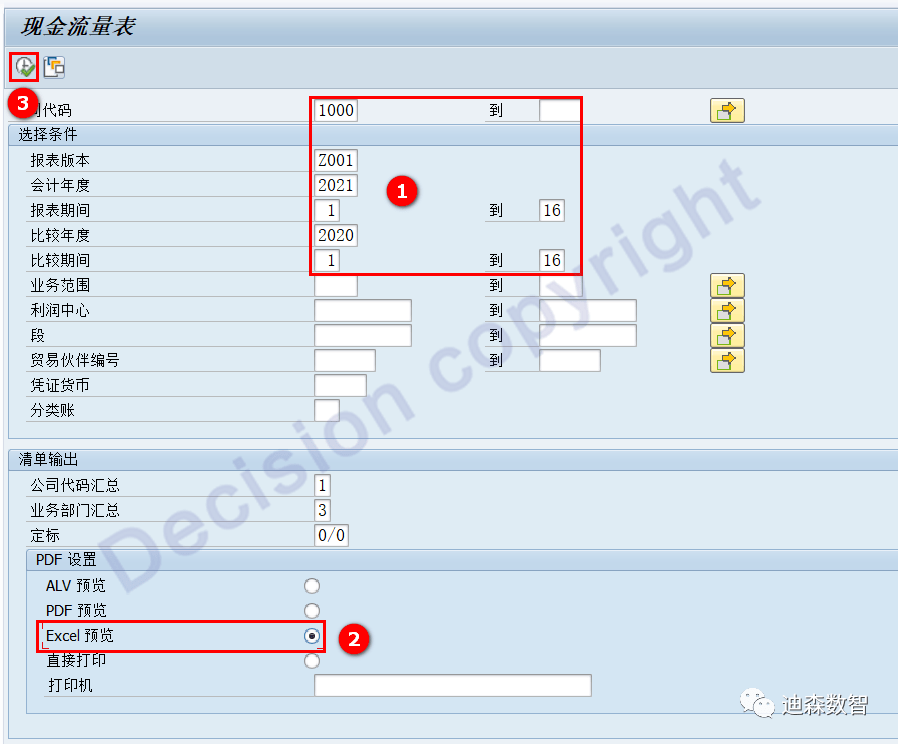

③ Report front-end output

Transaction code IDCNCASH

Accounting -> Financial Accounting -> General Ledger -> Period Processing -> Closing -> Reports -> General Ledger Reports -> Financial Statements/Cash Flow -> China -> Cash Flow Statement

[Common problem]

1. The problem of borrowing more and lending more

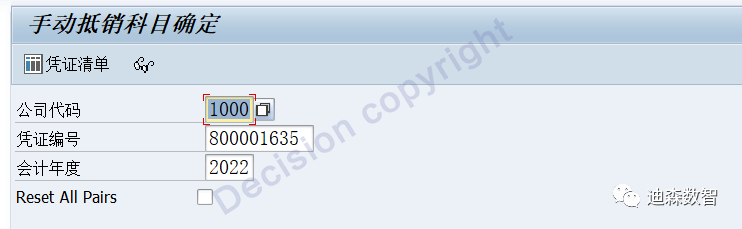

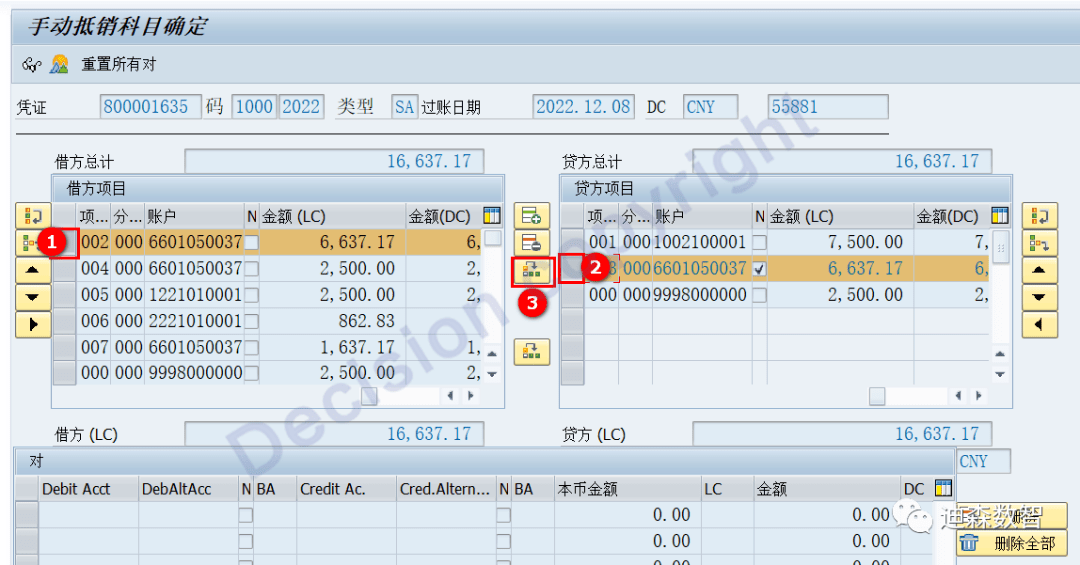

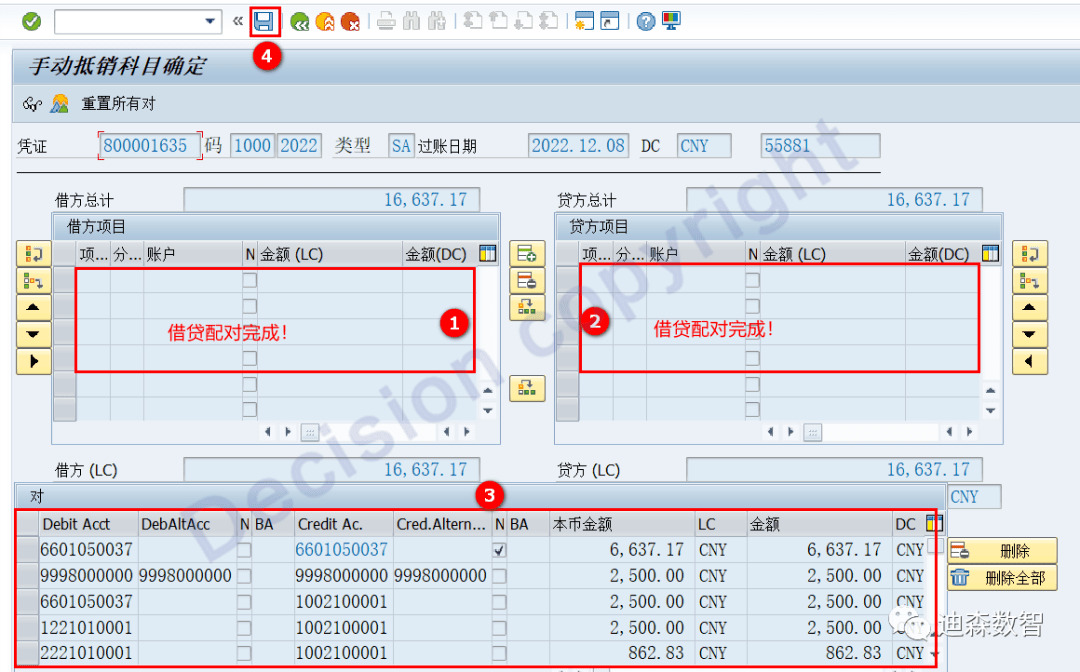

When using the above method to issue a cash flow statement, there is no problem with cash vouchers (one loan, one loan, one loan, multiple loans, multiple borrows, one loan), but there is a problem with (multiple borrows, multiple loans). Because the IDCNCASH cash flow statement supports the issuance of statements by the indirect method, when reading the voucher, the program first executes: all cash account line items are disassembled according to debits and credits; and then executes: direct method and indirect method to issue statements. Therefore, for cash voucher line items to appear (more borrows, more loans), the following processing is required:

Transaction code J3RKKRD

2. Anti-accounting issues

After enabling China's localized cash flow statement IDCNCASH, it was discovered that reason code = 111. When cash received from selling goods or providing services, only the debit balance in the BSEG table can be taken, and the system cannot take the credit balance.

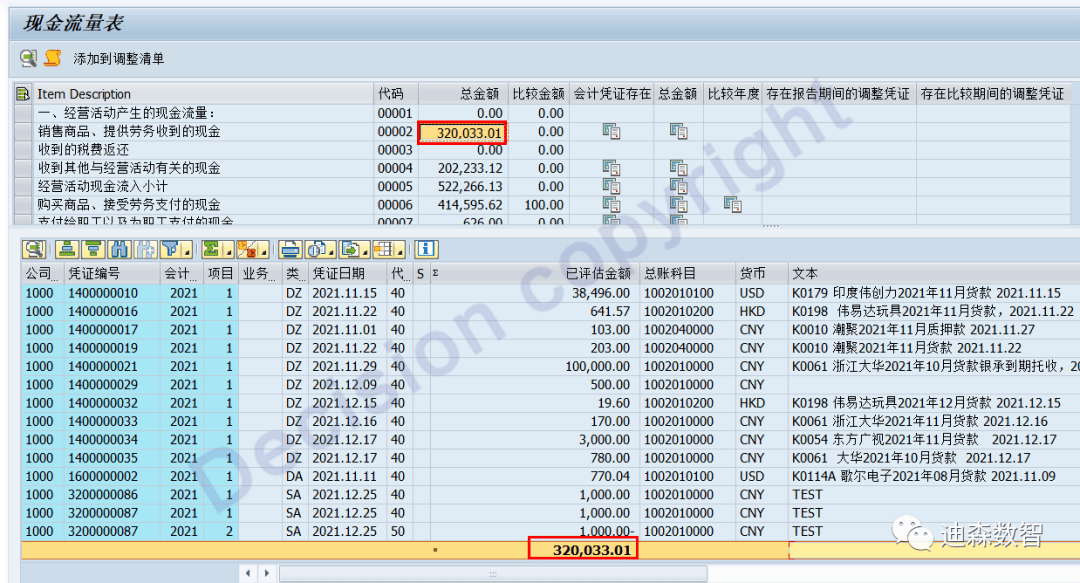

For example: The 111 cash flow amount obtained by IDCNCASH is 320033.01 yuan.

According to the voucher line item flow, the amount of cash flow 111 obtained for the current period is 319022.01 yuan.

The difference between the above two amounts is: 319,022.01 - 320,033.01 = -1,011.00 yuan

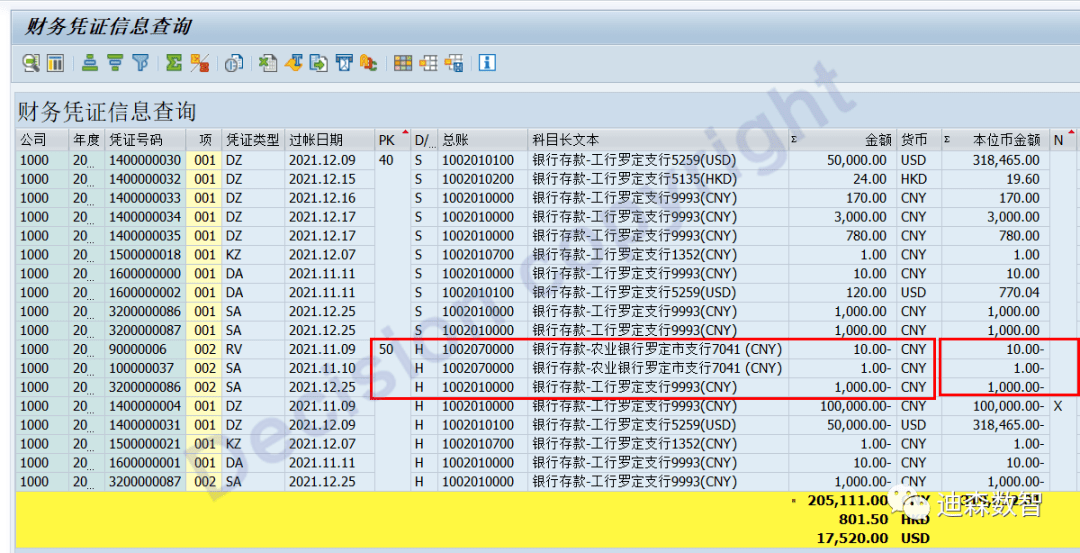

The discovery is the three amounts in the picture above. That is to say, 111 cash flow obtains the debit balance in the configuration. When the credit accounting code 50 appears in the voucher entry, the corresponding "reverse accounting" must be selected, otherwise the cash flow statement cannot obtain the data.

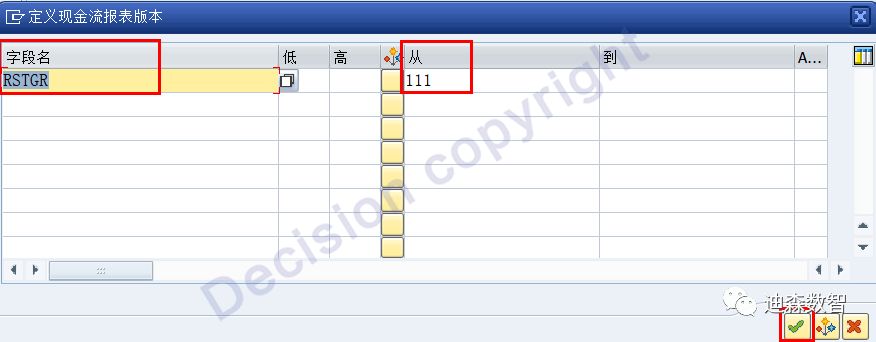

Attached: Cash flow statement 111 cash flow value setting

[Problem analysis and processing]

① Theoretically speaking, 111 cash flow can only occur on the debit side. If a credit occurs, you must choose: reverse accounting;

② From the current perspective of accountants using the SAP system to do accounting, it is difficult to make the right choice: reverse accounting;

③ This can only be achieved by enhancing the report, automatically sorting out debits and debits and reverse accounting before the report data is output.

【Service Guide】

For more information on SAP courses, project consultation and operation and maintenance, please call Decision's official consultation hotline: 400-600-8756

【About Decision】

Global professional consulting, technology and training service provider, SAP gold partner, SAP software partner, SAP implementation partner, SAP official authorized training center. Seventeen years of quality, trustworthy!