Time: 2023-09-28

Time: 2023-09-28  Views: 359

Views: 359

[Foreword]

The reason why Decision is highly praised by enterprises during the implementation of digital transformation projects is because experts are escorting Decision during the project process to help enterprises gain new knowledge, grow new capabilities, and improve management during the implementation of digital transformation projects. To improve our vision and reduce project misunderstandings, we have specially set up a "Decision Expert Column" to share with you a series of articles on the implementation of digital transformation projects, so stay tuned.

This article is based on Mr. Yang Yongqing, Decision’s chief financial expert, who has 24 years of rich experience in the field of SAP ERP, and combines the common misunderstandings he found in the implementation of ERP projects to publish corresponding research insights and suggestions to protect your SAP financial implementation and delivery.

[Problem Description]

In the SAP system, what is the pricing method for purchasing inventory raw materials, semi-finished products, finished products, and trading goods? V+2 or S+3? Such problems are often encountered in projects.

[Solution]

The company uses the S+3 pricing method for the following two inventories.

(1) Raw materials, semi-finished products, and finished products that constitute the product;

(2) Inventories purchased and sold within the group: raw materials, semi-finished products, and finished products;

1. Description of pricing method S+3

S refers to the daily receipt and receipt of daily inventory, which is priced at standard cost and multiplied by the number of receipts and receipts to calculate the change in inventory amount; 3 refers to enabling the SAP material ledger function to allocate cost differences. For warehousing: the inventory amount is divided into two amounts: one is the amount calculated according to standard cost, and the other is the cost difference; for outbound inventory, only one amount is recorded daily, and the outbound amount is calculated according to standard cost. After running the material ledger at the end of the period, the opening differences + incoming differences are summarized, and then apportioned to the outbound quantity and ending inventory quantity and posted. In this way: the outbound cost is two vouchers, one daily voucher is the standard cost, and one end-of-period voucher is the cost difference. The two vouchers are added together to get the actual cost.

If S+3 is replaced by the pricing method in financial accounting, it is: a weighted average at the end of the month!

2. Explanation of pricing method V+2

V refers to the real-time moving average pricing of daily shipments and receipts of daily inventory. That is to say, the moving average unit price will be calculated for each sending and receiving. Everyone can understand that the moving average unit price is updated every time it is put into storage. Why is the moving average price recalculated when outbound? For example, if the inventory quantity of material A is 3 units and the inventory cost amount is 1 yuan, then the moving average unit price is 333.33 yuan/1000 units. One unit is collected from the warehouse, and the calculated amount is 0.33 yuan. After the inventory is collected, the quantity is 2 units, the inventory cost amount is 0.67 yuan, and the recalculated moving average unit price is 335.00 yuan/1,000 units. It can be seen that because the outbound amount only retains two decimal places, the outbound amount will also affect the price change.

3. What is the function of the material ledger and what is its role?

Those who have studied financial accounting still remember that among the cost calculation methods, there is one called product costing. The material ledger is product method costing. That is: calculate the actual cost according to the receipt, receipt and storage of each material. Production orders account for the production cost of each work order; outsourcing processing purchase orders account for outsourcing production costs; network work orders account for project work order costs; purchase orders account for procurement costs. Inventories of large enterprises may come from multiple sources, which may be self-made production + outsourcing processing + procurement + allocation from group brother companies +... After summarizing the cost of the same material from multiple sources, there are multiple destinations for outbound delivery: production Receipt, department receipt, sales issue, sample issue, intra-group sales... and then there is the ending inventory. At this time, a material ledger is needed to fully calculate the cost of a material.

The material ledger mainly serves the following functions:

① Calculate the difference and allocate the difference according to each material; actual cost = standard cost + difference;

② Calculate the actual cost of each material, the actual cost of each batch of shipments, and the actual cost at the end of the period;

③ Restore the material and labor cost components of semi-finished products and production costs;

④ When multiple evaluation is enabled, three sets of costs are calculated at the same time: legal person costs, group costs, and profit center costs;

⑤ When multiple valuation is enabled, how much unrealized gross profit within the group is included in the legal person cost in the restored inventory;

⑥ When multiple valuation is enabled, the material and labor cost component of the group cost in inventory is restored;

⑦ Issue a complete inventory receipt, receipt and deposit report, the beginning and end of the period are exactly the same as the general ledger accounts, and the quantity and amount of receipts and receipts are exactly the same as the voucher;

⑧ When multiple evaluation is enabled, the group version of the receipt, receipt and deposit report and the profit center version of the receipt, receipt and deposit report can also be issued;

⑨ When multiple evaluation is enabled, when analyzing the gross profit of the same sales revenue, you can match the legal person cost, group cost, and profit center cost to analyze the gross profit from three perspectives;

4. Why can’t V+2 pricing be used?

① Raw materials cannot use V price

1.1 Every purchase of raw materials placed into the warehouse is tentatively estimated based on the purchase order price, not the final purchase settlement price; the purchase order price sometimes floats, that is, it floats based on the market price, and is based on a price when it is put into the warehouse. The predetermined price is a tentative estimate, and the price can only be determined at the end of the period. If the raw materials have quality defects, impurities, unstable content, delayed delivery, poor appearance, etc., payment will usually be deducted during purchase settlement after concessions are accepted. In addition, corporate procurement may involve tiered prices. Which level of tiered prices is reached will only be known after the end of the period. There are also purchasing rebates and unplanned expenses during the purchasing process (freight, warehousing, impurity removal, and deburring). These differences are determined only after the fact and cannot be determined at the time of storage or collection.

1.2 Raw materials may also come from group purchases, and the costs of sellers within the group need to be determined after the end-of-period cost settlement. When triple evaluation is enabled, the group cost of raw materials purchased within the group cannot be truly restored.

② Self-produced semi-finished products and finished products cannot use V price

2.1 Only the actual quantity of raw materials used is input in the production order; but not the actual quantity of all materials used. Materials such as glue, soldering wire, screws, and adhesive strips only have standard daily consumption. It is necessary to wait until the final workshop on-site inventory to determine the monthly consumption, and the difference must be apportioned.

2.2 When reporting work for a production order, the labor and fee operation prices used are the planned operation prices. Because wages, offices, utilities, depreciation, etc. in the production workshop can only be determined at the end of the month. Moreover, the workshop production efficiency of the month, how much work can be provided, and how many orders can be produced need to be determined at the end of the month.

2.3 Some people may ask, since production is based on piece-rate wages, can’t labor costs be determined? My reply is: only partially sure. The wages of direct personnel on the production line are calculated on a piece basis, but not all: there are also full attendance awards, performance awards, annual leave, employee off-the-job training, social security, provident fund... These are also components of labor costs, but they cannot be accurate for each product.

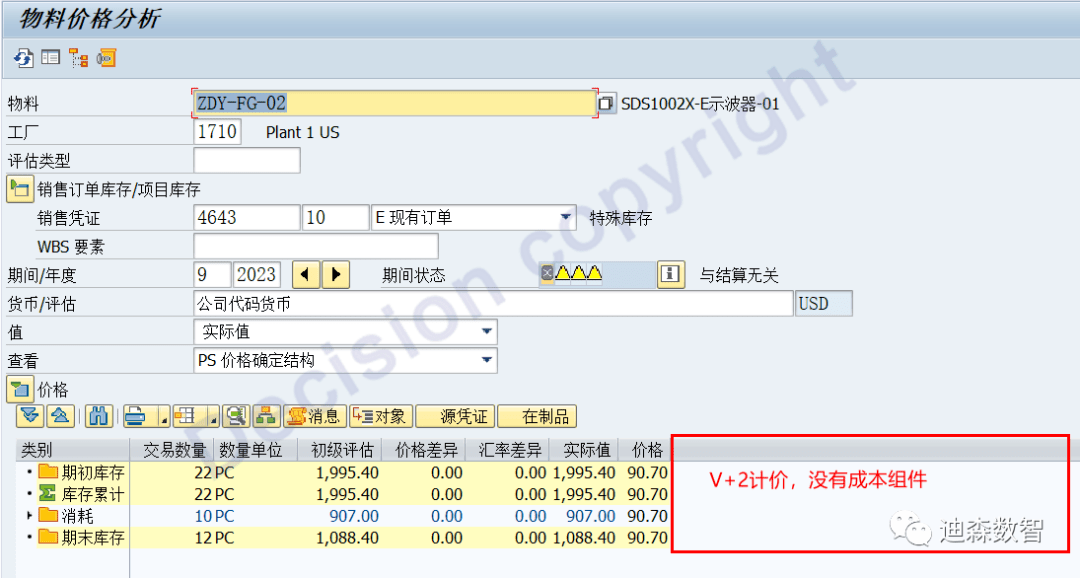

③After V+2 pricing, the composition of cost materials and labor components cannot be seen in the material ledger.

The following is V+2

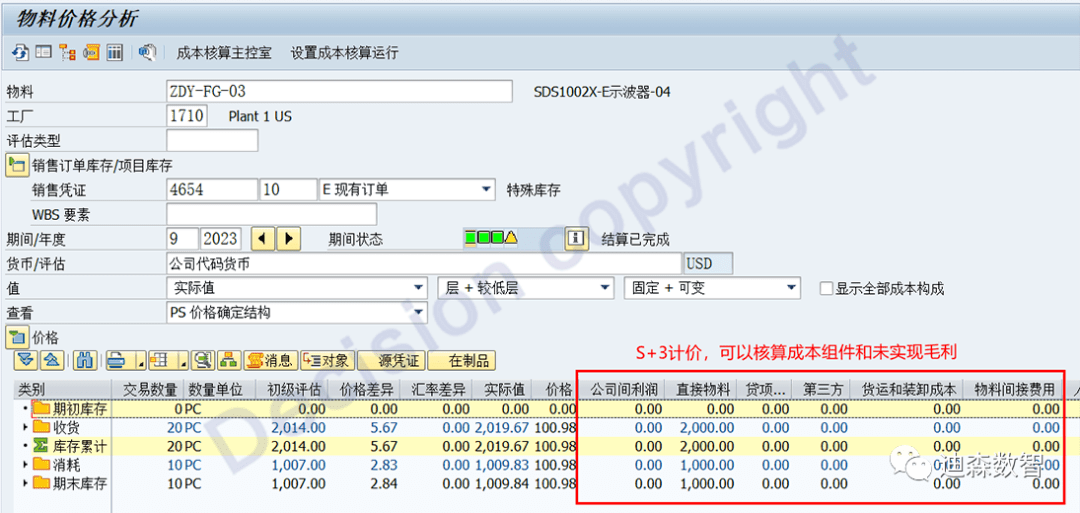

The following is the S+3 pricing, you can see the cost components

5. Can I use V+3 pricing?

Can we use V+3 pricing, that is, daily real-time moving average, and use the material ledger to supplement the apportionment differences at the end of the period. It's a good idea, but the SAP system does not have this pricing method. Although you can also see the material master data of V+3, this pricing method is nominal pricing and is not used for inventory measurement and accounting. For example: After batch split evaluation is enabled, the level pricing method of "Material A + 1001 Factory" is: V+3.

"Material A + 1001 factory + Z001 batch", "Material A + 1001 factory + Z002 batch", "Material A + 1001 factory + Z001 batch"... The pricing method is: V+2 or S+3. The quantity and amount of inventory in "Material A + 1001 Factory" are summarized based on the following batches, so they are displayed as V+3. This V+3 cannot be used for inventory measurement and accounting.

6.Which inventory can use V+2?

Office supplies, consumables, and labor protection supplies can be priced using V+2 or S+3.

7. For all materials

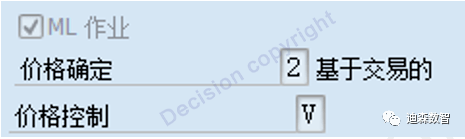

Material master data accounting view 1, check: ML operation, because all material receipts and deposits need to be issued through the material ledger report!

If it is not checked, when issuing a material receipt, receipt and inventory report to the auditor, multiple reports will need to be issued, and together they can be reconciled with the general ledger inventory amount.

8. The company’s raw material prices fluctuate greatly. Can’t the weighted average at the end of S+3 reflect price fluctuations on a daily basis?

This is a misunderstanding. S+3 pricing is a weighted average at the end of the month, which means that the posting of locked differences at the end of the period can only be processed once at the end of the month. For the full month plus calculation cost difference, the calculation of the difference to be borne by the warehouse and the end of the period can be calculated at any time, and the calculation results can be queried at any time.

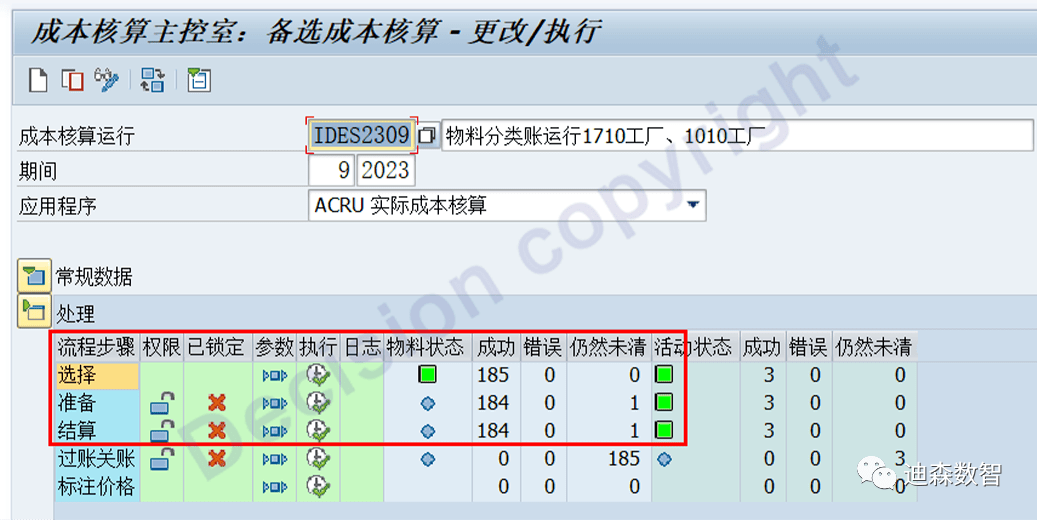

The first three steps of the material ledger can be calculated and run every day, and there is no need to wait until the end of the month! ! ! Only the fourth step is posted, which needs to be processed until the end of the month. After running the first three steps, you can query the material ledger report! ! !

If you run the CKMLCP material ledger daily (or hourly), it is equivalent to a real-time moving average, but without the final posting lock.

9. Why do many companies use V+2 to price their raw materials when using material ledgers for domestic projects that were completed in the past ten years?

Because of the following reasons:

① In the early days, the SAP material ledger function was not powerful enough and had many defects; after ECC6.0 EHP4, the function became more perfect;

② After the S4HANA version, the material ledger function is more powerful and runs faster (basically completed within half an hour)!

③ The material ledger in the ECC system has higher standard cost requirements and must be released at the beginning of the month, before material movement occurs.

④ The material ledger in the ECC system takes up a lot of resources and runs slowly, often running for 3-4 hours;

⑤ The material ledger function has higher requirements for implementation consultants

- Implementation consultants need to have a complete understanding of the impact of movement types on the material ledger;

- Implementation consultants need to fully master standard cost calculation, marking, and release, and understand standard cost logic;

- The implementation consultant can correctly create custom movement types and adjust the material account to inbound or outbound as needed;

- The implementation consultant fully understands the unallocated and unallocated logic and can handle the unallocated and unallocated differences;

- The implementation consultant has a comprehensive understanding of the cost component structure;

- The implementation consultant understands the structure of the material ledger data table and can clearly describe the report FS (because the material ledger report needs to be developed).

⑥ Enabling triple evaluation requires higher implementation consultants

- Implementation consultants need a thorough understanding of parallel ledgers

- Implementation consultants need to fully understand the three-tier evaluation processing logic

- Implementation consultants need to fully understand standard cost releases for three-tier assessments

- The implementation consultant needs to fully understand the group's inventory purchase and sales processing plan

- The implementation consultant has a comprehensive understanding of the unrealized gross profit calculation logic and adjustment plan;

- The implementation consultant masters the plan for issuing reports for the group's receipts, receipts and deposits, and profit centers' receipts, receipts and deposits.

If you would like to ask more questions and needs about digital transformation projects and learn more about Decision’s innovative solutions, you are welcome to contact Decision and we will answer your questions.

Consultation hotline: 400-600-8756

WeChat: Decision_SAP

Email: public@decision-it.com

Note: This article is the original work of Yang Yongqing. No individual or institution may reproduce or quote large sections for commercial purposes without his consent.

【Service Guide】

For more information on SAP courses, project consultation and operation and maintenance, please call Decision's official consultation hotline: 400-600-8756

【About Decision】

Global professional consulting, technology and training service provider, SAP gold partner, SAP software partner, SAP implementation partner, SAP official authorized training center. Seventeen years of quality, trustworthy!