Time: 2025-10-31

Time: 2025-10-31  Views: 256

Views: 256

[Foreword]

Decision has been deeply involved in the SAP field for more than 19 years and has been praised by many customers. In order to better help customers implement digital projects, the "Decision Expert Column" is completely free and open source, paying tribute to Musk's open source spirit!

Based on the senior capabilities of Decision's expert consultant team with more than 20 years of SAP experience, combined with Decision's 1,000+ successful project cases, this article summarizes and publishes the corresponding research experience and suggestions of enterprises in promoting ERP project implementation, and continues to escort the SAP implementation and delivery of enterprises.

[Problem description]

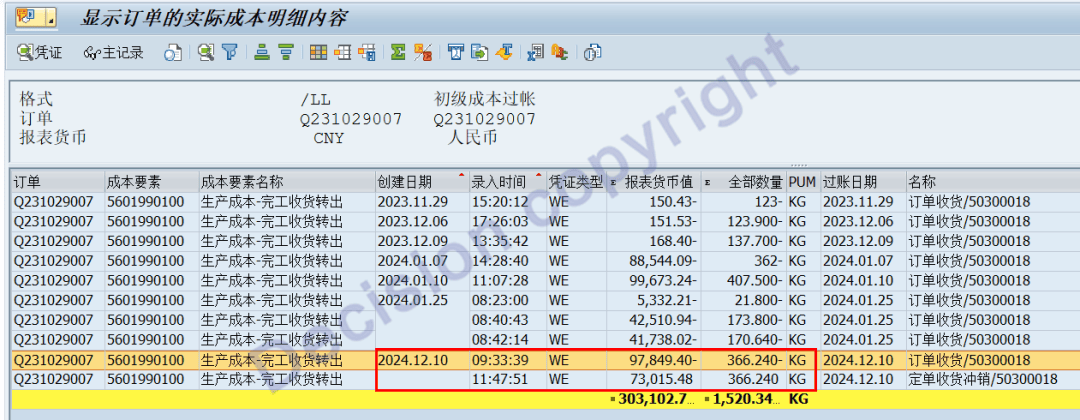

On the morning of December 10th, 366.24KG of goods were received into the warehouse for production order Q231029007. An error was discovered two hours later, and the receipt was reversed accordingly. No new standard cost was issued between the receipt and the reversal. After the reversal, the receipt amount and the reversal amount were found to be inconsistent. What could be the reason for this?

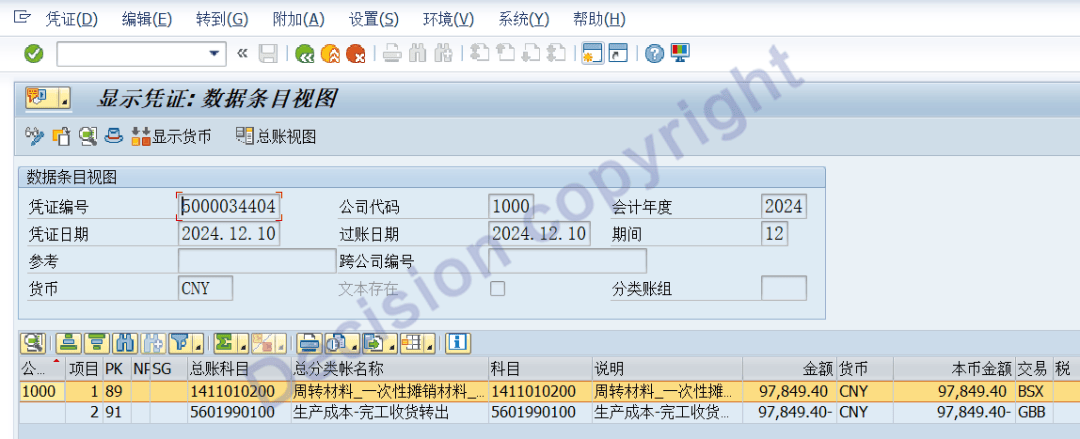

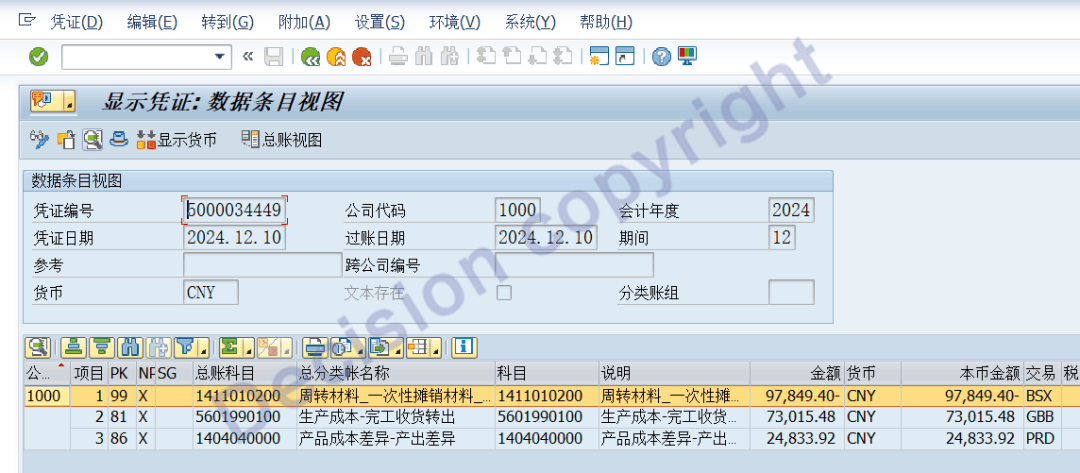

Inbound FI voucher.

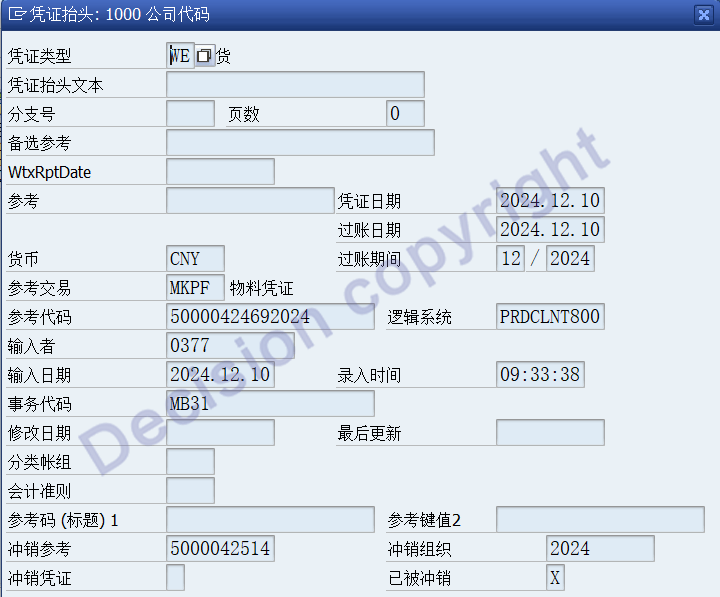

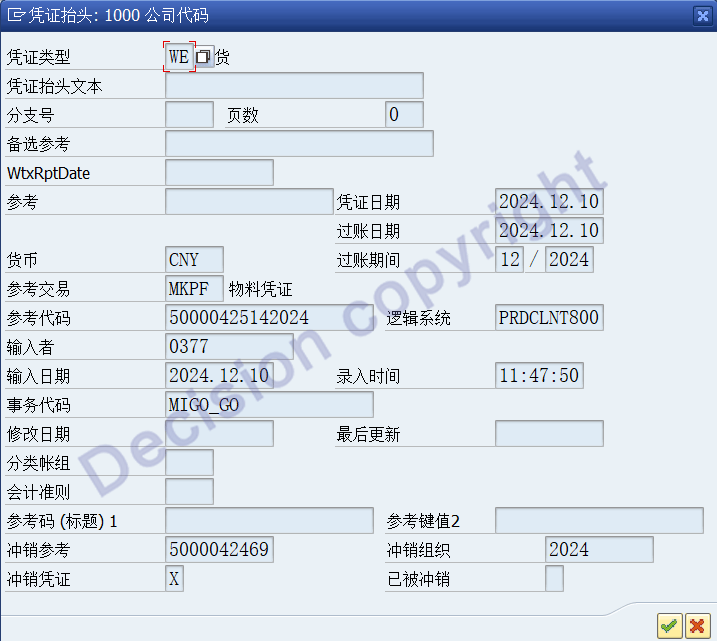

Cancel the inbound voucher.

[Problem Analysis]

1. In SAP material documents, each receipt and issue, including reversal documents, generates a new FI (Financial Invoice) document independently.

Reversals in material receipts and issues occur only at the material document level, not the FI document level.

Therefore, the production receipt of 366.24 KG and the reversal of the production receipt of 366.24 KG are not a pair of reversals at the FI level.

2. The logic for production order receipt document amounts is based on product inventory, using the standard cost of the inventory products.

Production order transfer: = Order product standard cost * Quantity received

Finished goods receipt: = Product standard cost * Quantity received

Therefore, the order product standard cost = Product standard cost, so the debit and credit amounts are equal: 97,849.40 yuan.

Transaction code CK13N, viewing the standard cost, and entering the quantity 366.24 KG, shows the standard cost as: 97,849.40 yuan.

3. The logic for reversing the amount of a production order receipt voucher is as follows: The target object is the product in the production order. The average cost of receipt for the production order is taken, the quantity of CO03 received is exported, and the sum of the quantity and amount before reversal is calculated. Then, the price is calculated.

As shown in the diagram below, before reversal, the calculated average cost of receipt for the production order is: 199365.13 yuan/1000 KG.

Therefore: The order transfer cost for reversing 366.24 KG = 366.24 * 199365.13 / 1000 = 73015.48 yuan.

The cost of goods entering the warehouse is still calculated based on the standard product cost: the standard cost for 366.24 KG is 97,849.40 yuan.

Therefore: the cost difference is 97,849.40 - 73,015.48 = 24,833.92 yuan.

[Solution]

Summary:

Production orders have been received in multiple months, with different standard costs for each receipt.

To reverse production orders, calculate the average cost by summing the quantity and amount of received goods.

No special processing is required.

【Service Guide】

For more information on SAP courses, project consultation and operation and maintenance, please call Decision's official consultation hotline: 400-600-8756

【About Decision】

Global professional consulting, technology and training service provider, SAP gold partner, SAP software partner, SAP implementation partner, SAP official authorized training center. Nineteen years of quality, trustworthy!